Monthly Review December 2021

January 24, 2022

Preface – Economic Climate

The Israeli economy is an advanced economy that belongs to the OECD organization. The GDP per capita is $50,656 and the growth rate in 2021 is estimated by 7.1%.

The Corona crisis has affected the Israeli economy as significantly as other economies in the world. The deficit in January 2021 – December 2021 is 4.5% from the GDP, the debt-to-GDP ratio is 70.3% The unemployment rate is 4.5% but the unofficial unemployment rate climbed to about 6.3%. The new government provided a good signal to the markets by approving a new budget for the first time in 3 years. From a monetary point of view, the crisis is being managed professionally by the Bank of Israel, which is monitoring the local credit market and solving liquidity problems through plans to purchase bonds and keep interest rates low.

In December the fifth wave of corona virus continued to spread; however, the restrictions on the economy were minimal. As a result, the Israeli economy is functioning again and there was a decrease in unemployment.

Along with economic stabilization, there has been an increase in the inflation rate, as of December the annual rate is 2.8%. The chief economist in the ministry of finance predicts a similar increase next year as well; an increase in prices and inflation is a factor that must be taken into account in the coming years.

Statistical Profile

Society

Population (November 2021): 9.437 Million

Economy

GDP per capita: $ 50,656

Inflation: 2.8% Annual Growth Rate

Current Account Balance (Q3 2021): 4.3% of GDP

Trade in Goods and Services (December 2021): $13.62 billion

Finance

US Dollar Exchange rate (December 2021): NIS 3.13

Euro Exchange rate (December 2021): NIS 3.54

Long-term interest rates (December 2021) : 1.2% Per Annum

Short-term interest rates (December 2021): 0.010% Per Annum

Government

Debt to GDP ratio (December 2021): 70.3%

Deficit to GDP (January 2021 to December 2021): 4.5%

Motorization

Level of Motorization (2020): 397 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2019): 4.9% of GDP

Environment

CO2 Emissions (2018): 6.98 Tonnes Per Capita

Jobs

Employment Rate (December 2021): 64.4% of Working Age Population

Official Unemployment Rate (December 2021): 4.5% of Labour Force

Unofficial Unemployment Rate (including non-paid absence due to Covid-19): 6.3% of Labour Force

New Cars and CV Registrations

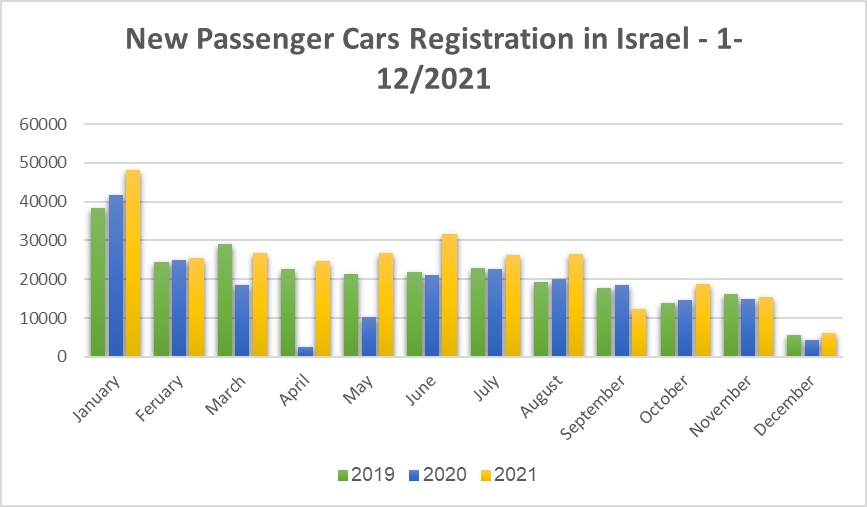

New Passenger Car Registration: January- December 2021

Passenger car registration: +37.3% compared with December 2020; Since January 2021, an increase of 34.8% compared with Jan-Dec 2020.

In December 2021, the Israeli passenger car market registered 6,122 new cars - an increase of 37.3% compared with December 2020. For the full year, January-December 2021, a new sales record was registered with a total of 289,291 new cars - an increase of 34.8% compared with FY 2020.

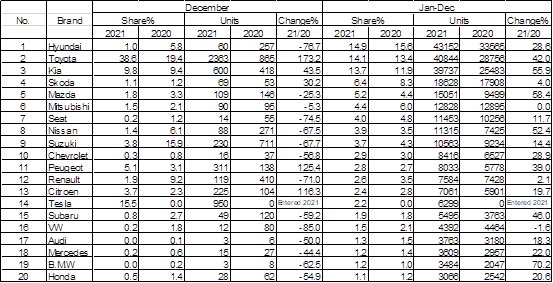

New Passenger Cars Registration According to Brands: January-December 2021

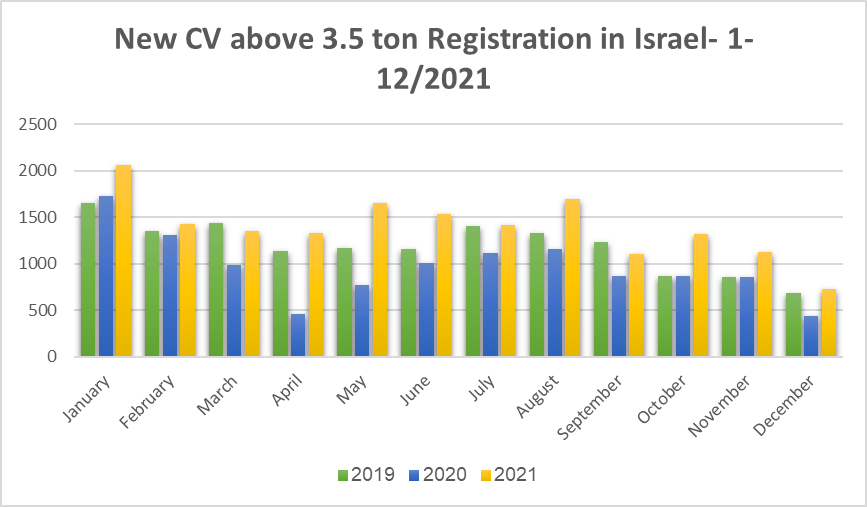

New CV above 3.5 ton Registration: January-December 2021

Commercial Vehicles above 3.5 ton registration: +66% compared with December 2020; Since January 2021, an increase of 44.5%.

In December 2021, the Israeli market for CV above 3.5 ton registered an increase of 66% in registrations with 734 new registrations, compared with 442 units in December 2020. Since January 2021, 16,721 new CV and buses were registered – an increase of 44.5% compared with Jan-Dec 2020.

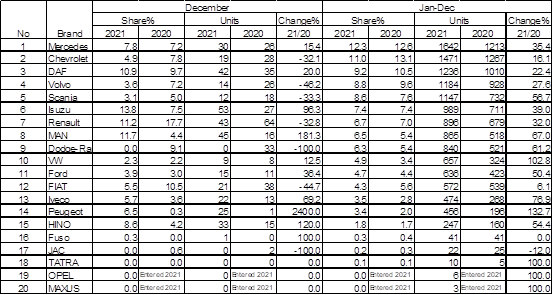

New CV above 3.5 ton Registration According to Brands: January-December 2021

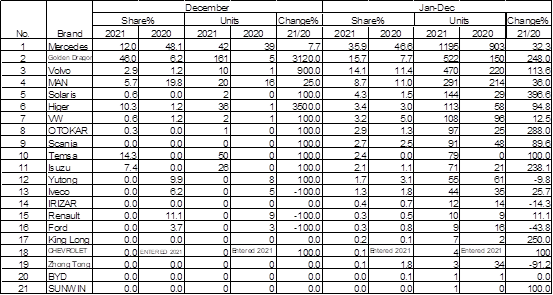

New Bus Registration According to Brands: January-December 2021

Israel's Auto and Auto-Tech industry

Gnrgy Wins Tender for Government Offices Charging Stations

Gnrgy, part of OPC Energy Group, won a tender for the installation of hundreds of EV charging stations in government offices. The company will install and operate the charging stations, and government employees will be able to charge their EVs using a dedicated Gnrgy-Go App. In recent years, Gnrgy has already installed 12,000 charging stations in Israel.

Driivz Sold to American GVR for 700M$

Israeli Driivz, specializing in supplying cloud-based software for EV service providers such as large fleets and charging stations, was sold to Gilbarco Veeder-Root (GVR) for 700m$. The company, established in 2011, developed in 2013 an online platform for energy management called Vehicle-to-Grid. Over the years, Driivz drew investors such as Centrica and Volvo. The company currently employs 80 employees, most of them in Israel.

Qualcomm Semiconductors to Work with Israeli Cognata

Semiconductor giant Qualcomm chose Israeli Auto-tech start-up Cognata's simulation platform for its' advanced safety platform Snapdragon Ride. The platform developed by Cognata enables 3D realistic environments with accurate digitized coordination and addition of moving and interactive objects. This will facilitate full synchronization in the development of ADAS by Qualcomm.

Tadir-Gan to Supply Audi with 15M$ Worth of Components

Ortal Diecasting, a daughter company of Tadir-Gan precision products, will supply Audi with 15M$ worth of Magnesium components for EVs. Ortal was chosen as an exclusive supplier, and the components will be supplies over the course of 5 years and will be used in EVs produced by Audi. Ortal already supplies leading manufacturers such as GM and MAN.

Mobileye to Collaborate with Geely's Zeeker to Produce an AV

Mobileye and Zeekr, the global premium electric mobility technology brand from Geely Holding Group, announced plans to expand their strategic technology partnership with the goal of developing a new all-electric consumer vehicle with Level 4 (L4) capabilities. The planned autonomous vehicle (AV) will be built using Mobileye Drive™ technology, together with the open SEA architecture, and expanding on Zeekr’s existing models. Debut of the new AV is expected in 2024, initially in China and then across global markets.

REE Presents New P7 Platform for Delivery Companies

REE Automotive, an electric platform leader reinventing e-mobility, showcased a new EV platform designed for commercial delivery vehicles in the CES in Las-Vegas. The new platform is called P7 is fully-flat, it has a max payload of 4 tons and it measures 7.6X2.4 meters. Its top speed is 130 Km/h and the expected range is 595 Km.

Ministry of Transportation Opens a Security Operation Center

Following hacker attacks on public transportation company's servers, the ministry of transportation opens a Security Operation Center to handle cyber threats in transportation. The SOC will monitor cyber activity, identify weaknesses and deal with threats related to transportation management systems, road infrastructure, ports, PT companies and trains. The cost pf operating the SOC is estimated at 5M NIS a year.