Trends Analysis of the Israeli market for new vehicles - Q2 2023

July 20, 2023

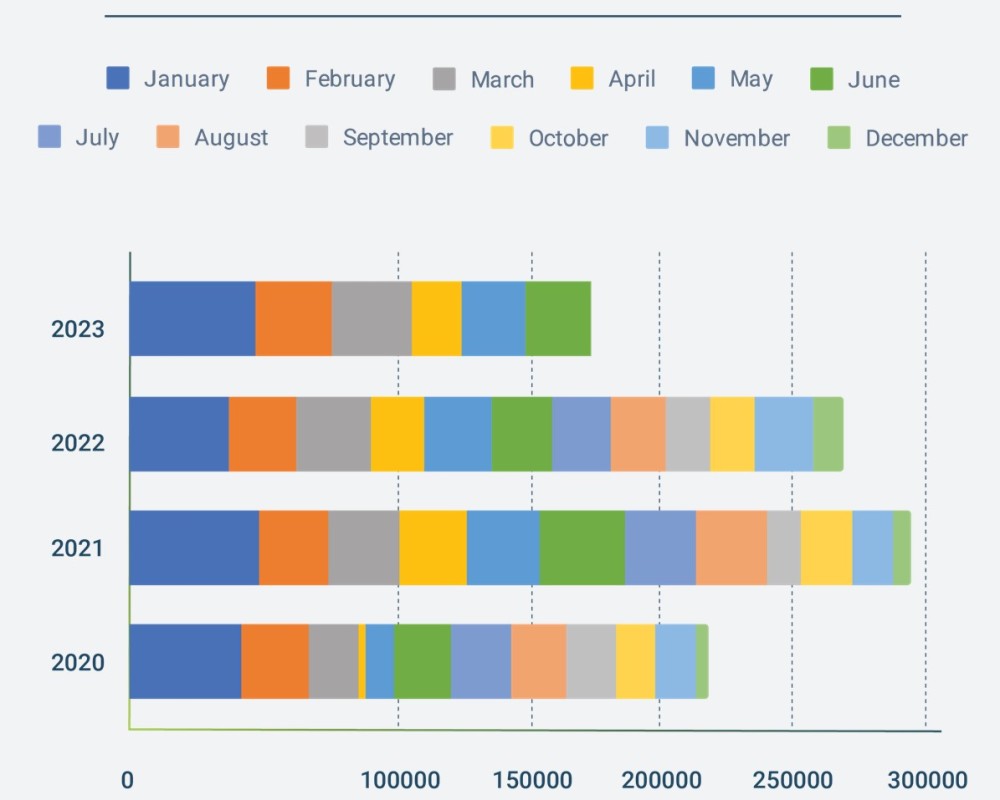

Registration Data

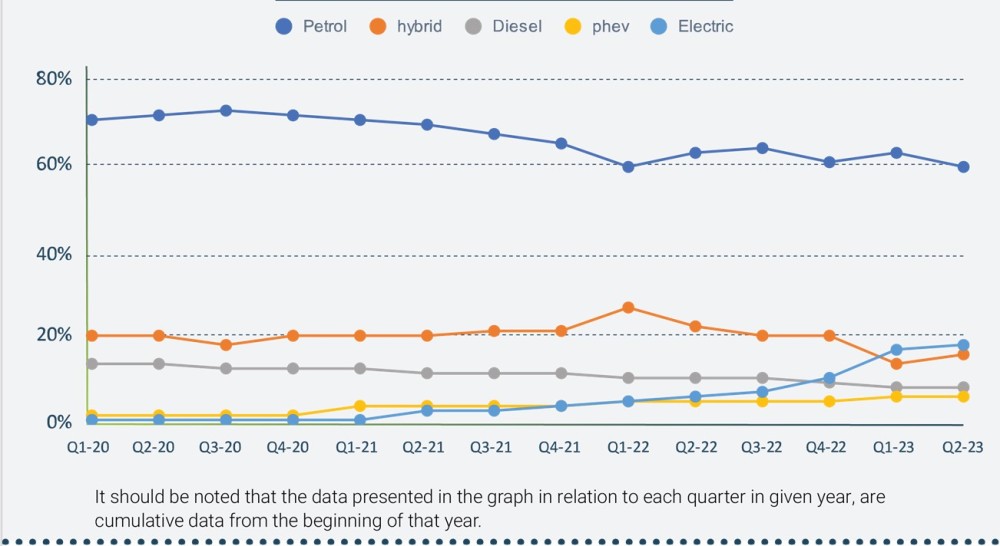

Registration by Engine Type

In the second quarter of 2023, Israel experienced a shift in vehicle registration trends. Fewer petrol cars hit the roads, making up just 55% of new vehicle registrations, which marks a 3% reduction compared to the first quarter of the year. When this figure is compared with the same quarter in 2022 and 2021, the decline stands at 3% and 9% respectively.

Contrastingly, electric vehicles continued to surge in popularity. With a 1% increase compared to the first quarter of 2023, and a more notable 11% and 14% rise relative to Q2 2022 and Q2 2021, they now account for 17% of all new vehicles in Israel.

Hybrid Electric Vehicles also saw an increase in demand in Q2 2023, contributing 15% to the new vehicle registrations. However, it's important to note that this actually indicates a dip from previous years, with a decrease of 6% and 4% from Q2 2022 and Q2 2021 respectively.

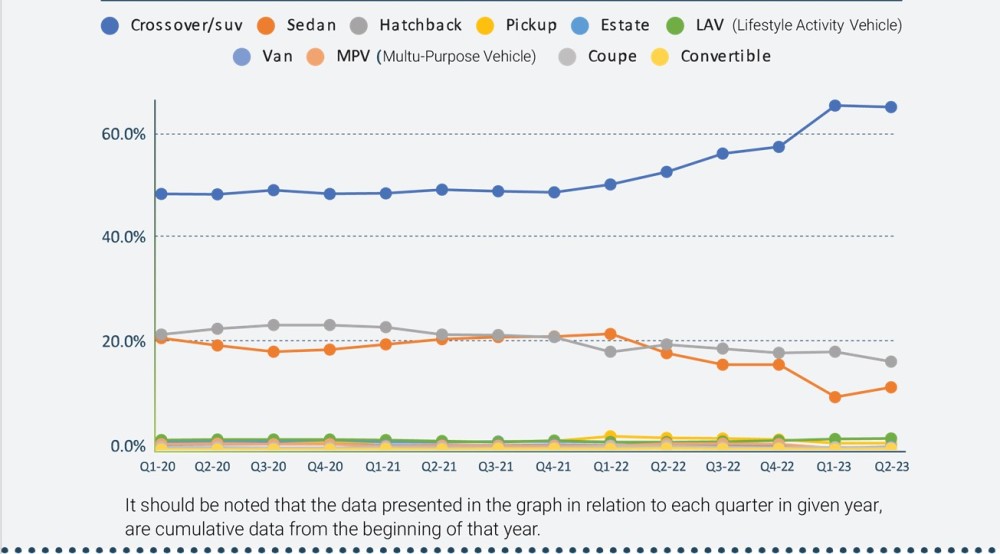

Registration by Segment Type

Over the recent years, the Crossover/SUV segment has remained a constant favorite among new vehicle buyers in Israel. In Q2 2023, the popularity of this category held steady, making up 65.5% of all new vehicles. This represents a significant jump of nearly 12.5% from Q2 2022 and an even more notable 15.8% hike from Q2 2021.

On the other hand, the Hatchback vehicle segment has experienced a slight downward trend. Despite this, hatchbacks still constituted 16.9% of all new vehicles in Q2 2023, maintaining their spot as the second highest volume category for new vehicles in the country.

Meanwhile, the Sedan segment witnessed a small increase of nearly 2% from Q1 2023, accounting for 12% of all new vehicle registrations. However, when compared with the same quarter in previous years, this figure shows a decrease of 3.3% from Q2 2022 and 5.2% from Q2 2021.

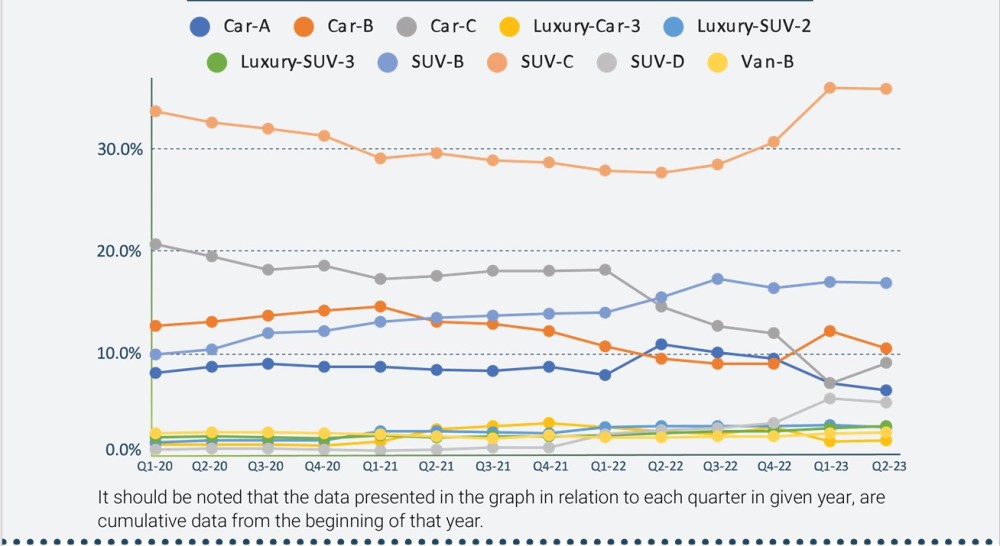

Registration by Category

In Q2 2023, the SUV-C segment retained its top spot in the Israeli new vehicle market, accounting for 35.8% of all new vehicles. This signifies a notable 8.2% increase from the same quarter in 2022 and a 6.3% rise from the corresponding period in 2021.

Meanwhile, the SUV-B segment held steady, comprising 16.8% of all new vehicles. This is slightly higher than its market share of 15.4% during the same period in 2022 and 13.4% in the corresponding period of 2021. This stable demand places the SUV-B segment as the second most popular category of new vehicles in Israel.

On the other hand, the Car-B category faced a reduction in Q2 2023, making up just 10.4% of all new vehicles. This represents a slight drop of 1.7% from Q1 2023, yet interestingly, it also indicates an increase of 1% compared to Q2 2022, and 3.4% compared to Q2 2021.

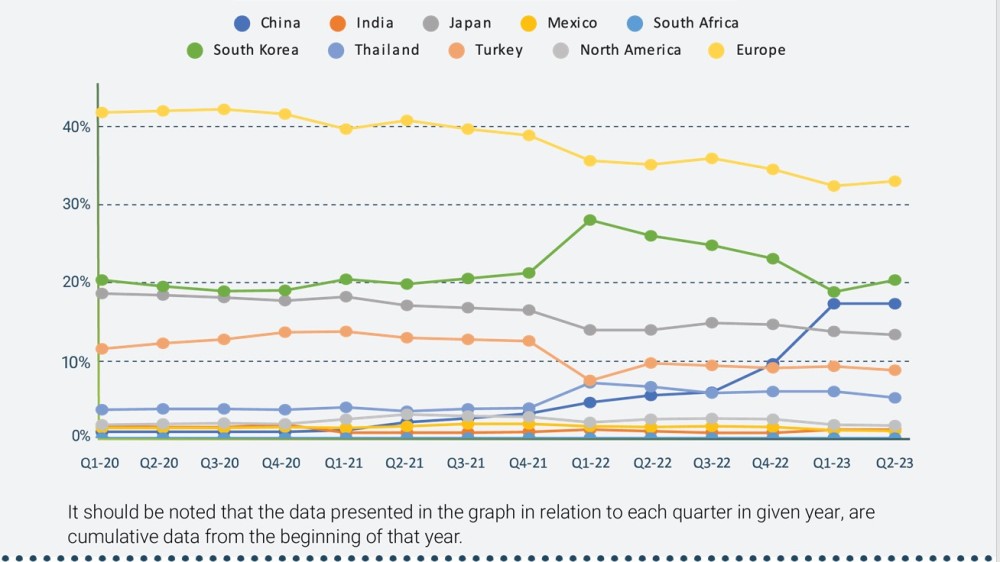

Registration by Country of Origin

During Q2 2023, vehicles made in Europe represented 32.5% of all new vehicle registrations in Israel, demonstrating a minor increase of 0.6% from Q1 2023. However, when compared to Q2 2022 and Q2 2021, there was a 2% and 7.7% drop respectively.

South Korean vehicles also saw a rise in demand from Q1 2023, comprising 20% of all new vehicles in Q2 2023. Despite this increase, there was a 5.6% decrease compared to Q2 2022, and a minuscule 0.5% increase when compared to the same period in 2021.

Meanwhile, the demand for vehicles manufactured in China stayed consistent, making up 17% of all new vehicles in Q2 2023. This static demand marks a significant surge of 11.6% from Q2 2022, and 15% from Q2 2021.

Lastly, vehicles produced in Japan and Turkey saw a slight drop in demand. They contributed to 13.1% and 8.6% of all new vehicle registrations in Q2 2023, respectively.