Trends Analysis of the Israeli market for new vehicles - Q3 2023

November 8, 2023

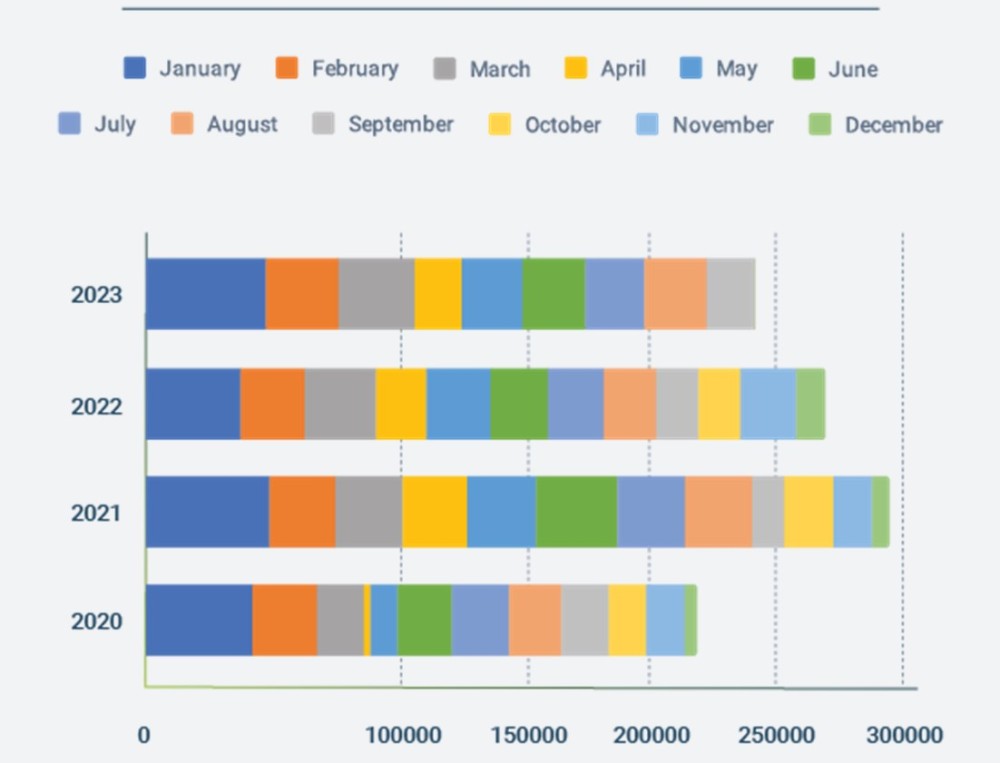

Registration Data

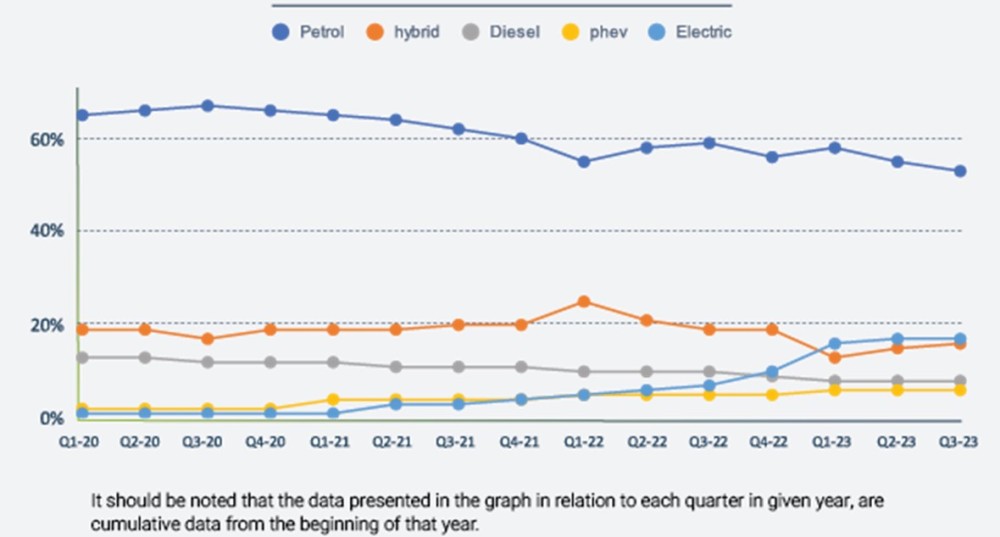

Registration by Engine Type

In Q3 2023, Israel's automotive landscape reflected a sustained move towards alternative fuel vehicles. Petrol vehicles have seen a downturn in registrations, commanding 53% of the market, a slight reduction from 55% in Q2 2023. This reflects a 6% year-on-year decline from Q3 2022's 59% and a more pronounced 9% drop from the 62% share in Q3 2021.

Electric vehicles, holding a 17% market share, demonstrate consistency with the previous quarter and a remarkable year-over-year growth—a 10% leap from Q3 2022's 7% and a substantial 16% surge from the 1% in Q3 2021. This underscores a significant shift towards electric propulsion in the Israeli market.

The hybrid sector witnessed a slight uptick to 16% of new registrations, up from 15% in Q2 2023. This is 3% lower than the same quarter the previous year and represents a decrease from the 20% observed in Q3 2021. Plug-in hybrid electric vehicles (PHEVs) maintained a stable 6% share of new vehicle registrations, which is identical to the previous quarter. This figure has doubled from Q3 2022's 3% and shows a threefold increase from 2% in Q3 2021.

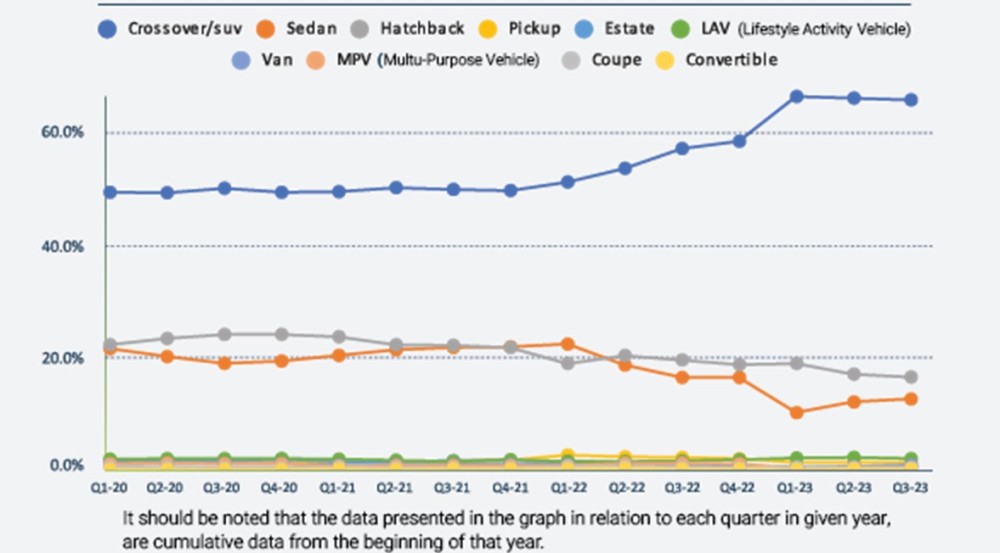

Registration by Segment Type

Crossover/SUVs maintained their dominance in the market, making up 65.3% of new vehicle registrations in Q3 2023. This figure represents a marginal decrease from the 65.6% seen in the previous quarter, yet when viewed year-over-year, it shows a significant growth of 8.6% from Q3 2022's 56.7%, and an even more considerable 15.7% increase from Q3 2021's 49.6%. This demonstrates the consistent appeal of Crossover/SUVs among Israeli consumers.

Hatchbacks saw a slight quarter-over-quarter decline to 16.4% in Q3 2023 from 16.9% in Q2 2023. The year-over-year analysis indicates a decline from 19.4% in Q3 2022 and a noticeable drop from 22% in Q3 2021.

Sedans experienced an increase in their share of new vehicle registrations to 12.5% in Q3 2023, up slightly from 12% in Q2 2023. Compared to the same quarter in previous years, this represents a decrease of 3.8% from the 16.3% seen in Q3 2022, and a more substantial decline of 9.1% from the 21.6% recorded in Q3 2021.

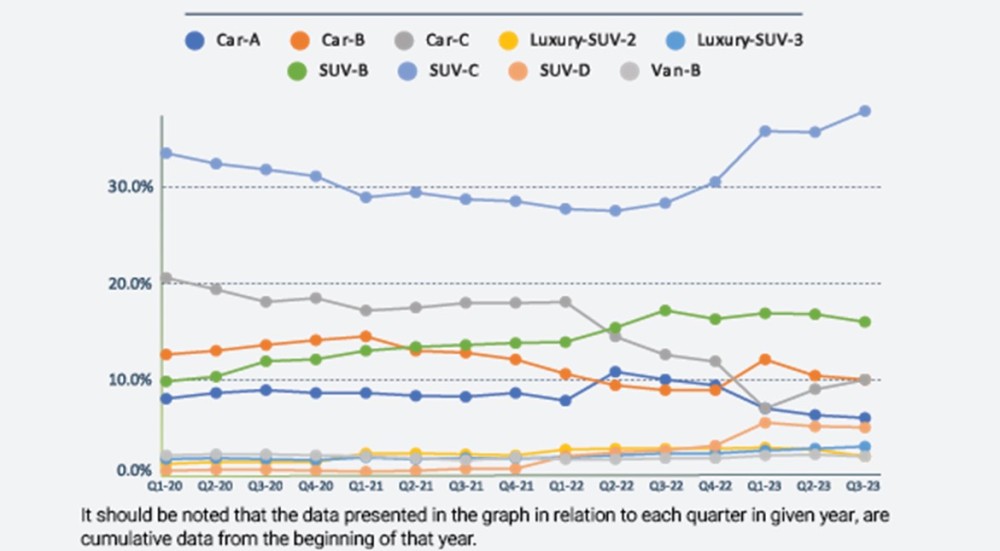

Registration by Category

In Q3 2023, the SUV-C segment continued to dominate the Israeli new vehicle market, securing a significant 38% of total new vehicle sales. This reflects a remarkable increase of 9.6% from Q3 2022, when its market share was 28.4%, and a substantial rise of 9.2% from Q3 2021, which stood at 28.8%. Such growth reinforces SUV-C’s position as the foremost choice among new vehicle consumers in Israel.

The SUV-B segment, on the other hand, exhibited a dip in Q3 2023, accounting for 13.4% of new vehicles, a decrease from its 17.2% market share in Q3 2022. However, this figure is relatively stable when compared to the 13.6% share during the same quarter in 2021.

In Q3 2023, the Car-B segment's market share was 10%, a slight decrease from 10.4% in the previous quarter. Despite this quarter-over-quarter decline, the market share has increased compared to 8.9% in Q3 2022, though it's a reduction from 12.8% in Q3 2021.

For Car-C, the Q3 2023 market share stood at 10%, showing a decrease from the previous quarter's 9.0%. This is a more significant drop from the 12.6% market share in Q3 2022 and the high of 18.0% in Q3 2021.

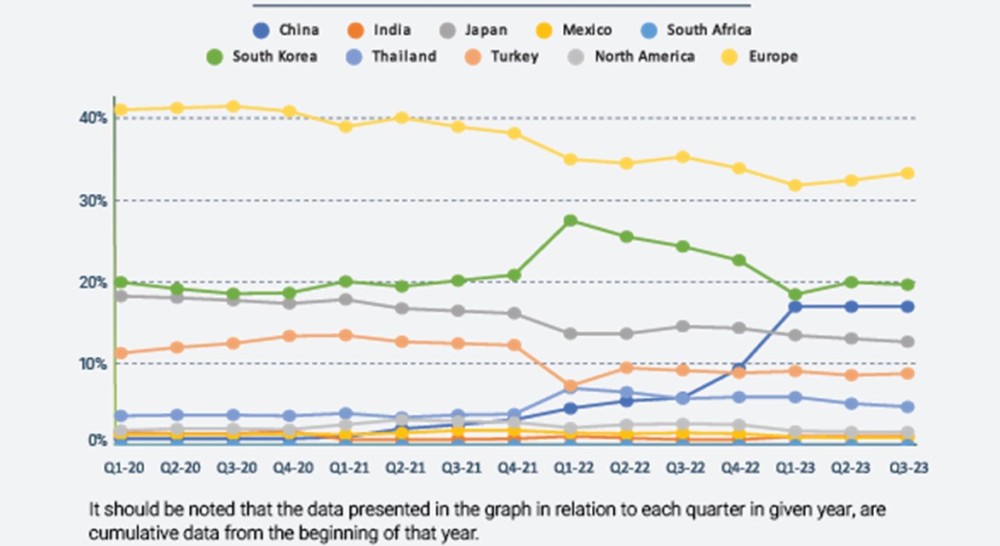

Registration by Country of Origin

As of the third quarter of 2023, European-made vehicles accounted for 33.4% of the new vehicle market, reflecting a 2.4% decrease from January to September of 2022, and a 6.1% fall from the January to September period in 2021. Following a spike in interest during the second quarter of 2022, the preference for South Korean-made vehicles in Q3 2022 has leveled off, constituting 19.7% of the market—a figure consistent with two years prior, yet marking a 4.7% reduction from the same quarter in 2022. Chinese-made vehicles have maintained a steady market presence since the year's start, forming 17% of all new vehicle sales. This steadiness underscores a notable increase of 11.2% from the third quarter of 2022, and a 14.5% jump from the third quarter of 2021. Japanese-made vehicles have sustained their market share since the year's onset, making up 12.7% of new vehicle sales in Q3 2022. Lastly, the Turkish-made vehicle market share has remained consistent throughout the past year, at 8.8% in Q3 2023, which shows a decline of 3.7 points when compared to the same period in 2021.