Trends Analysis of the Israeli market for new vehicles - Q4 2023

January 17, 2024

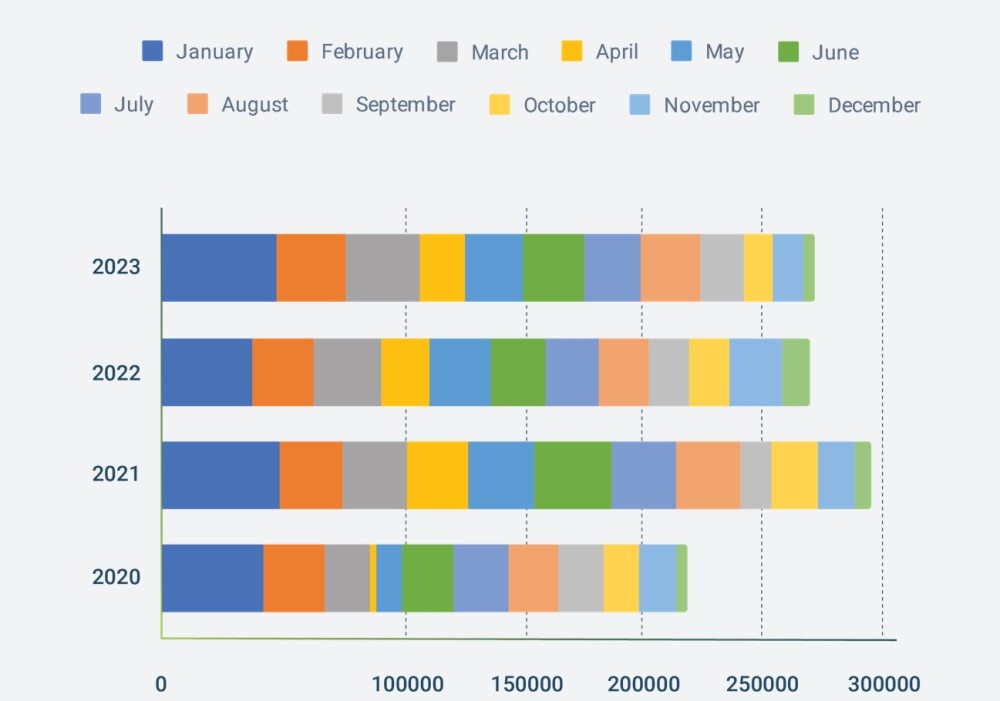

Registration Data

Registration by Engine Type

In Q4 2023, the trend towards alternative fuel vehicles in Israel's automotive market persisted. Petrol vehicle registrations fell to 51%, continuing their decline from 53% in Q3 2023 and down from 56% in Q4 2022, illustrating a steady move away from petrol dominance.

Electric vehicles saw their share increase to 18%, a 1% rise from Q3 2023, marking significant progress from Q4 2022's 10%, and a rapid climb from just 3% in Q4 2021. This growth confirms the accelerating adoption of electric vehicles.

Hybrids held firm at 17%, showing almost no change from the previous quarter but a dip from 19% in Q4 2022, reflecting a slight fluctuation in their market share over the year. Despite this, the commitment to hybrids remains notable.

Registration by Segment Type

In Q4 2023, Crossover/SUV segments retained their strong position in the Israeli vehicle market, accounting for 65.0% of new vehicle registrations. This is a slight decrease from the 65.3% registered in the previous quarter (Q3 2023). However, the segment has shown remarkable year-over-year growth, up from 58% in Q4 2022 and a significant jump from 49.3% in Q4 2021, underscoring the growing consumer preference for this vehicle type.

Hatchbacks observed a decrease in market share to 16.3% in Q4 2023, down from 18.6% in Q4 2022. This also marks a reduction from the 21.6% held in Q4 2021, indicating a two-year declining trend for this segment.

Sedans experienced a reduction in their market share to 12.9% in Q4 2023, a decrease from 16.3% in Q4 2022, and substantially lower than the 21.7% seen in Q4 2021. This suggests that sedans are facing a decreasing market presence over a period marked by increasing competition from Crossover/SUVs.

Registration by Category

Heading into the final stretch of 2023, the Israeli automotive sector demonstrated clear consumer preferences. Dominating the landscape, the SUV-C segment achieved a commanding 37.4% of new vehicle registrations in Q4 2023, marking an ascent from 30.6% in Q4 2022 and a substantial growth from 28.6% in Q4 2021.

Following behind, the SUV-B category held a share of 15.6%, reflecting a slight decline from the 16.3% in Q4 2022 but an increase from the 13.8% in Q4 2021, reinforcing its consistent demand over the years.

The Car-C segment, with a 10.6% share in Q4 2023, saw an uptick from 10% in Q3 2023, yet it represented a decrease from 11.9% in Q4 2022 and was significantly lower than the 18% stake it held in Q4 2021, indicating a more volatile trajectory.

Lastly, Car-B segment's presence stood at 9.4% in Q4 2023, an improvement from 8.9% in Q4 2022 but still a drop from the 12.1% seen in Q4 2021, suggesting shifting consumer preferences within the smaller vehicle categories.

Registration by Country of Origin

In Q4 2023, Israel's vehicle registration data revealed a sustained preference for certain countries of manufacture. European vehicles, while still leading, dipped to 32.7% from Q3's 33.4%, and saw a downward trend from 34.0% in Q4 2022 and 38.3% in Q4 2021.

South Korean vehicles, consistent quarter-to-quarter at 19.7%, actually reflect a slight decrease from the previous year's 22.7% in Q4 2022, showcasing some volatility but generally holding a strong position in the market.

Chinese vehicles showed significant growth, increasing to 17.5% in Q4 2023, up from 17.0% in Q3, and more than doubling from 9.4% in Q4 2022, indicating a rapidly expanding market presence.

Japanese vehicles saw a minor dip to 13.1% from the previous quarter's 12.7%, and a decrease from 14.4% in Q4 2022, suggesting a slight ebb in interest.

The Turkish-made vehicles registered a share of 8.7% in Q4 2023, showing a gradual decline from 12.3% in Q4 2021.