Monthly Review June 2021

July 21, 2021

Preface – Economic Climate

The Israeli economy is an advanced economy that belongs to the OECD organization. The GDP per capita is $ 45,958 and the growth rate in 2010-2019 was the average annual growth rate of 3.3% per year. At the beginning of the Corona crisis, the debt-to-GDP ratio was 60% and was one of the lowest in the Western world. The government deficit was 3.7% and the unemployment rate was 3.4%.

The Corona crisis has affected the Israeli economy significantly, as have other economies in the world. The deficit in June 2020 –May 2021 is 10.5% from the GDP.The debt-to-GDP ratio is 74.9% The unemployment rate rose to 5.1% but the unofficial unemployment rate climbed to about 9.8%. Along with the economic crisis in Israel, there is also a political complexity and the indecisive results new election in March 2021 that makes it difficult for the government to pass a new budget and formulate a coherent economic policy. On the other hand, from a monetary point of view, the crisis is being managed professionally by the Bank of Israel, which is monitoring the local credit market and solving liquidity problems through plans to purchase bonds and keep interest rates low.

In April, the population immunization intensified and the limits of the corona were lifted. As a result, the Israeli economy returned to function and therefore there was a decrease in unemployment. The end of the health crisis will undoubtedly lead to a recovery in the economic situation during 2021. According to the forecasts of the Chief Economist in the ministry of finance, growth in 2021 is expected to reach 4.6%.

Statistical Profile

Society

Population (March 2021): 9.341 Million

Economy

GDP per capita: $ 45,958

Inflation 1.5% Annual Growth Rate

Current Account Balance (Q1 2021): 5.08% of GDP

Trade in Goods and Services: (May 2021) $11.6 billion

Finance

US Dollar Exchange rate: NIS 3.24

Euro Exchange rate: NIS 3.94

Long-term interest rates (May 2021) : 1.2% Per Annum

Short-term interest rates (May 2021): 0.00% Per Annum

Government

Debt to GDP ratio: 74.9%

Deficit to GDP (May 2020 to May 2021):10.5%

Motorization

Level of Motorization (Q4 2020): 394 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2019): 4.93% of GDP

Environment

CO2 Emissions (2017): 7.3 Tonnes Per Capita

Jobs

Employment Rate (Q1 2021): 65.40% of Working Age Population

Official Unemployment Rate (May 2021): 5.1% of Labour Force

Unofficial Unemployment Rate (May 2021) (including non-paid absence due to Covid-19): 9.8% of Labour Force

New Cars and CV Registrations

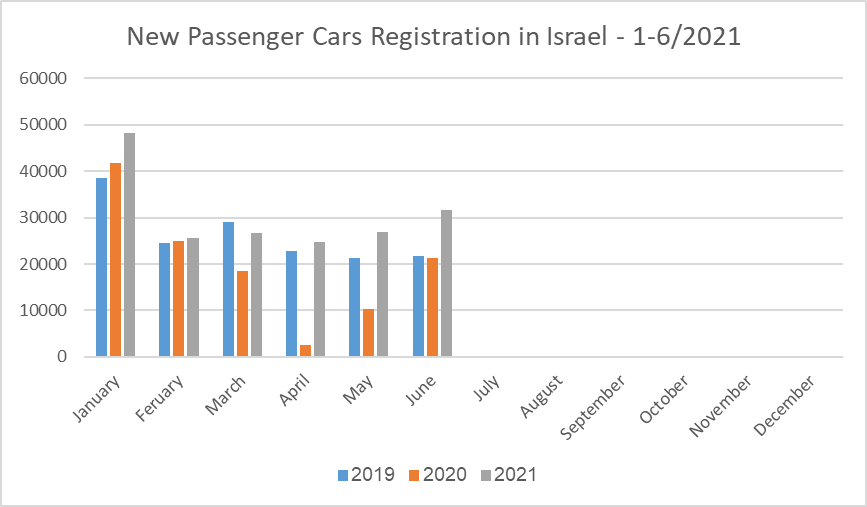

New Passenger Car Registration: January-June 2021

Passenger car registration: +49.5% compared with June 2020; Since January 2021, an increase of +54.1% compared with Jan-June 2020. In June 2021, the Israeli passenger car market registered 31,722 new cars. This figure represents an increase of 49.5% compared with June 2020. Since January, 183,801 new cars were registered – an increase of 54.1% compared with Jan-

June 2020, and a new registration record for H1 of a calendar year

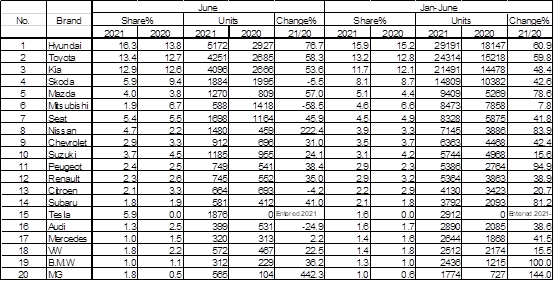

New Passenger Cars Registration According in Israel 1-6/2021 According to Brands

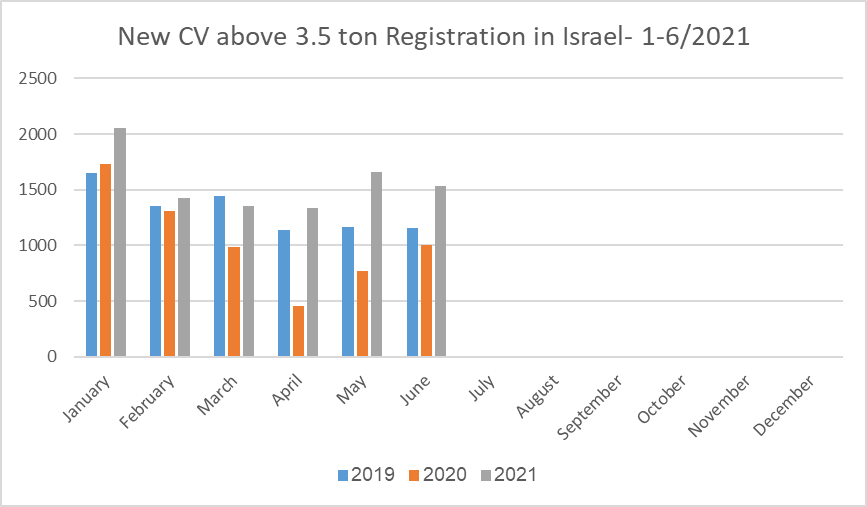

New CV above 3.5 ton and Bus Registration in Israel 1-6/2021

Commercial Vehicles above 3.5 ton registration: +52.4% compared with June 2020; Since January 2021, an increase of 49.2%

In June 2021, the Israeli market for CV above 3.5 ton registered an increase of 52.4% in registrations with 1,536 new registrations, compared with1,008 units in June 2020. Since January 2021, 9,358 new CV and buses were

registered – an increase of 49.2% compared with Jan-June 2020.

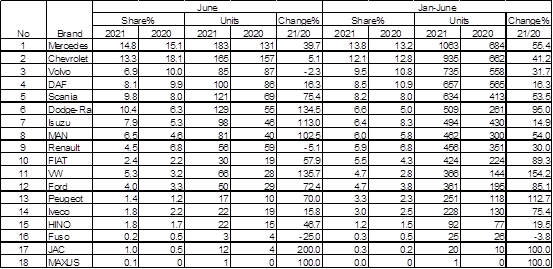

New CV above 3.5 ton Registration According to Brands: January-June 2021

New CV above 3.5 ton Registration in Israel 1-6/2021 According to Brannds

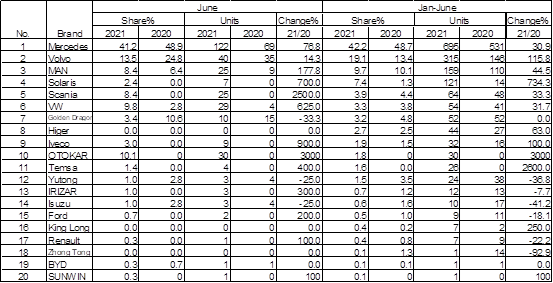

New Bus Registration in Israel 1-6/2021 According to Brands

Monthly review - Israel's Auto and Auto-Tech industry

REE Automotive Announces Strategic Collabotation with JB Poindexter to Develop Commerrcial Electric Vehicles

Israeli REE Automotive that developed a modular platform for EVs, announced a strategic collaboration with American JB Poindexter to develop commercial electric vehicles based on REE's platform. The companies will initially collaborate on the development of a next-generation modular walk-in van for the North American last mile delivery market, in which JB Poindexter & Co has a leading position of the 35,000/year market, with further collaboration to target additional North American commercial work truck customers and markets. The companies will first work to develop prototypes for a joint project by Q1, 2022 with production targeted for 2024. REE has recently announced that its registration statement related to business combination with 10X Capital Venture Acquisition Corp. was declared effective by the SEC – REE will be listed on NASDAQ under a new ticket symbol "REE".

Continental to Invest in Feelit

German Continental, one of the largest TIER-1 supplier for the automotive industry, announced an investment in Israeli start-up Feelit. Feelit was founded in 2017 and developed a printed chip based on nano-printing technology. The chip enables sensing and control of industrial components and is able to connect all kinds of equipment to the IOT using a wireless communication box. Continental invested in Feelit 3M$, and will integrate the Israeli technology into its products.

Porsche Ventures Invests in Motorsport Technology Start-up Griiip

Israeli start-up Griiip developed a cloud-based data platform that enables the transmission of motorsport data directly from the racing car, and then both analyses and visualizes this data in the cloud. Porsche Ventures, the venture capital division of Porsche, has taken a minority stake in Griiip, following a series of tests it carried out in order to test Griiip's technology.

ZF to Adopt ADAS Technology Developed by Israeli Cognata

German ZF will start using technology and algorithms developed by Israeli Cognata in a digital platform for testing the quality and reliability of ADAS for autonomous vehicles. The new platform, named ADAS.AI, enables converting data gathered in test drives into information that serves as a base for virtual testing of ADAS. By placing cameras and sensors in the test cars and using AI, the data can be analyzed and adjusted to different kinds of vehicles. The system is supposed to accelerate the development and testing of ADAS.

Servision Launches the New Generation of SDMS – Servision Driver Monitoring System

Servision/ADI Car Systems launches a new generation of its driver monitoring system. The SDMS identifies the driver's facial

features and actions, and alerts if there is a danger of an accident. The system identifies drowsiness, distractions, use of a cellphone, smoking and yawning. It can "remember" up to 20 faces, and is also able connects with the fleet management software.

SaverOne: a New Agreement with Flex Israel

SaverOne, developer of driver monitoring system, announced a new agreement with Flex Israel according to which the company will install the system in its fleet of 250 vehicles. The agreement follows a one month pilot phase that was completed recently. Flex Israel, a branch of Flex that employs 200,000 people worldwide, will introduce the system to additional branches of the company and SaverOne hopes it will help facilitate its penetration to the international market.

Netivei Israel is Promoting the Deployment of 100 Fast-Charging Stations along Israeli Highways

Netivei Israel, the national transportation infrastructure company, is promoting the deployment of 100 fast-charging stations

along Israeli highways in collaboration with private charging companies. Currently there are only a few dozen such stations outside of cities. The company mapped the road network and identifies 100 spots that have a high capacity power line nearby along with sufficient ground for paving entrance and exit lanes. The demand for EV's in Israel is growing, from 0.7% market share last year to 2.5% this year. The additional charging stations will support this demand and help drivers cope with "Range Anxiety".