Monthly Review October 2022

November 27, 2022

Preface – Economic Climate

The Israeli economy is an advanced economy that belongs to the OECD organization. The GDP per capita is $49,080 and the growth rate in 2021 is estimated by 8.1%.

Israel is recovering from the Covid-19 crisis that has affected the Israeli economy significantly since 2020. The deficit in November 2021 – October 2022 is negative -0.5% from the GDP.

The debt-to-GDP ratio is 62.5%. The unemployment rate is 4.3% but the unofficial unemployment rate is about 5.2%.

At this phase it is difficult to say how the election results will affect the Israeli economy. On the one hand, the stability that the new government will bring with it entails a promise of stability that will allow an orderly transfer of the budget for the coming years, on the other hand, the entry of the religious parties into the coalition may create pressure for a significant fiscal expansion which may increase the basic deficit and delay necessary reforms in the labor market.

Along with economic stabilization and quick growth, there has been an increase in the inflation rate, as of October 2022, the annual rate is 5.1%. The Chief Economist in the Ministry of Finance predicts a similar increase next year as well.

From a monetary point of view, the Bank of Israel is dealing with the rise of inflation. In October 2022, the interest rate was kept at 2.75% due to the rise of inflation, and it is expected to rise again.

Statistical Profile

Society

Population (September 2022): 9.603 Million

Economy

GDP per capita: $49,080

Inflation (October 2022): 5.1% Annual Growth Rate

Current Account Balance (Q2 2022): 2.73% of GDP

Trade in Goods and Services (October 2022): $ 12.891 billion

Finance

US Dollar Exchange rate (October 2022): NIS 3.55

Euro Exchange rate (October 2022): NIS 3.49

Long-term interest rates (October 2022): 3.3% Per Annum

Short-term interest rates (October 2022): 2.82% Per Annum

Government

Debt to GDP ratio: 62.5%

Deficit to GDP (November 2021 to October 2022): -0.5%

Motorization

Level of Motorization (2021): 406 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2020): 5.43% of GDP

Environment

CO2 Emissions (2018): 6.98 Tonnes Per Capita

Jobs

Employment Rate (Q3 2022): 69.51% of Working Age Population

Official Unemployment Rate (September 2022): 3.73% of Labour Force

Unofficial Unemployment Rate (including non-paid absence due to Covid-19): 5.2% of Labour Force

New Cars and CV Registrations

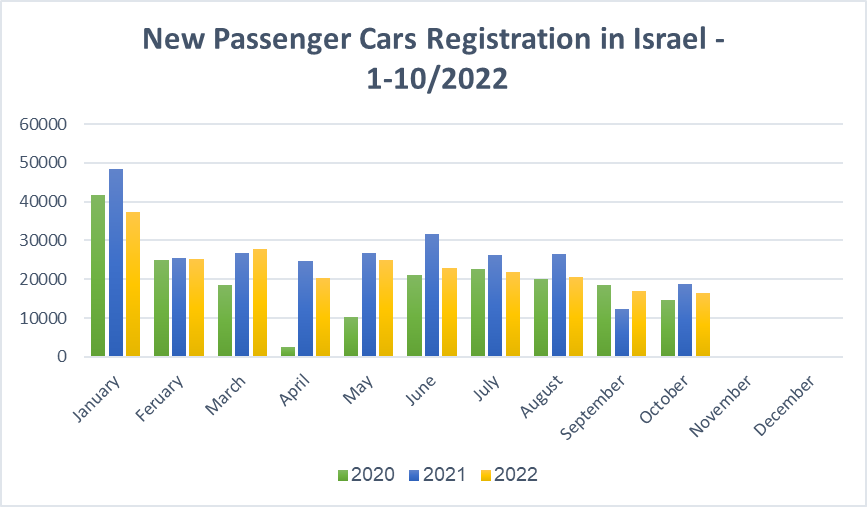

New Passenger Car Registration: Jan-October 2022

Passenger car registration: a decrease of 12.3% compared with October 2021; Since January 2022, a decrease of 12.8% compared with Jan-October 2021.

In October 2022, the Israeli passenger car market registered 16,467 new cars. This figure represents a decrease of 12.3% compared with October 2021. Since January 2022, have been registered 234,699 new cars – a decrease of 12.8% compared with Jan-Oct 2021.

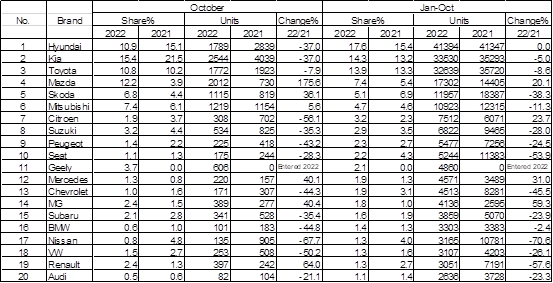

New Passenger Cars Registration According to Brands: Jan-October 2022

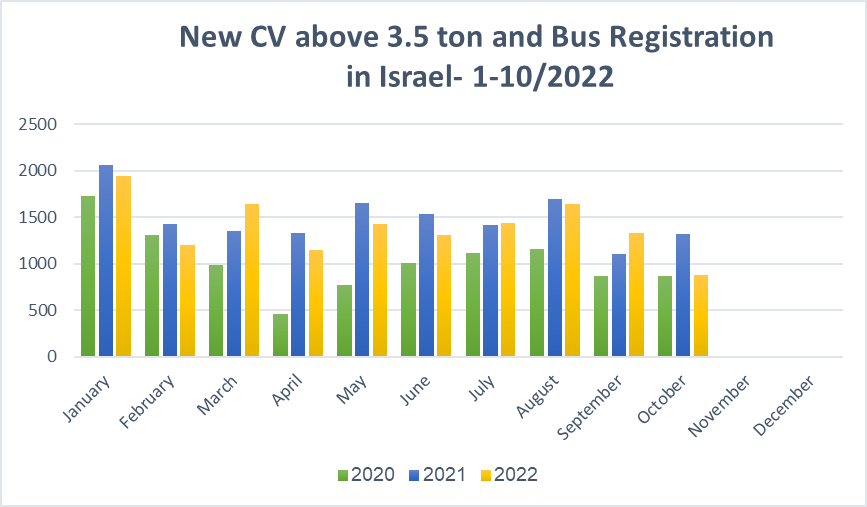

New CV above 3.5 ton Registration: Jan-October 2022

Commercial Vehicles above 3.5 ton registration: -33.3% compared with October 2021. Since the beginning of the year, a decrease of 6.2% in registrations.

In October 2022, the Israeli market for CV above 3.5 ton registered a decrease of 33.3% with 879 new registrations, compared with 1,318 units in October 2021. Since January, have been registered 13,958 units – a decrease of 6.2% compared with Jan-Oct 2021.

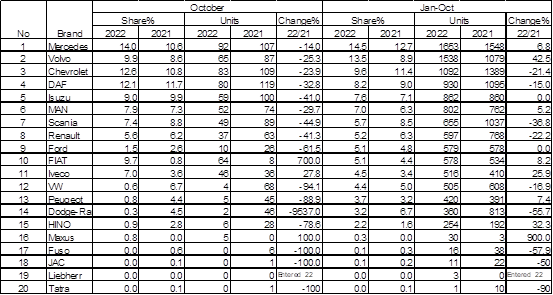

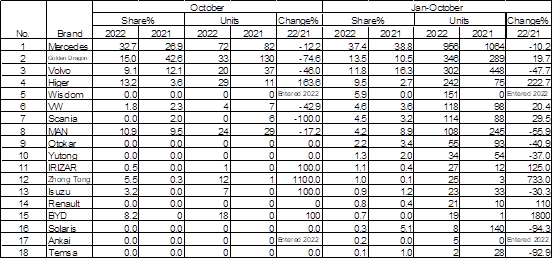

New CV above 3.5 ton Registration According to Brands: Jan-October 2022

New Bus Registration According to Brands:Jan-October 2022

Israel's Auto and Auto-Tech industry

SaverOne Enters the ADAS Sensors Market

SaverOne, developer of a safety system designed to tackle distracted driving due to cellphone use, is entering the ADAS market with a new VRU (Vulnerable Road Users (identification system. The company had completed a POC phase together with a " large European truck and bus manufacturer". The POC demonstrated the company's solution that identifies VRUs location and direction via their cell phone 's RF signature. According to SaverOne, this solution complements existing ADAS sensors such as Lidar, radar, and cameras, in harsh weather conditions and low visibility.

Aurora Labs Publishes 3rd Automotive Software Survey

Aurora Labs, a pioneer in using AI and Software Intelligence to solve automotive software development, conducted the 3rd automotive software survey together with Strategy Analytics. The companies surveyed more than 200 experts from the automotive and supplier industries, as well as experts from the software sector. According to the survey, more than 76% of respondents are planning to own an EV in the next few years. 44% of them would pay up to 20$ per month for additional features such as OTA updates. According to Aurora Labs, these findings indicate the speed of EV adoption and also that consumers are open to a new business model that could bring OEMs an additional and recurring revenue stream through software sales. 62% of the experts surveyed expect that OEMs will make up to 10% of their revenue from selling features and functions OTA by the year 2027.

ZOOZ Power Signs MOU with Leading Car Rental Service to Build and Operate a Fast-Charging Station at LaGuardia Airport

ZOOZ Power (formerly Chakratech), announced it has signed a binding memorandum of understanding for collaboration with a worldwide leading car rental service provider to build and operate a joint pilot EV ultra-fast charging station at LaGuardia airport. The Pilot is part of the car rental strategy to provide EV rental services. The goal is to have the pilot site operational during Q2/2023 for 12 months. Based on successful pilot, the parties will discuss a roadmap and agreement for a long-term cooperation, using ZOOZ Power’s products in additional sites.

Mobileye – a Public Company Again

Mobileye marks a return to the public markets for the first time since it was acquired by Intel in 2017. The company is traded on the NASDAQ stock exchange under the ticker symbol MBLY, and Mobileye shares closed up 37% in their stock market debut. Intel is expected to retain control of Mobileye and hold over 750 million shares of Class B stock, which has significantly more voting power than Class A stock.

EV-Aya Begins First Pilot for an Energy Storage System for EVs in a Shared Building

The first pilot of an energy storage system for charging EVs in a shared building in Israel was inaugurated in Ramla. The EV-Aya company has installed a system for charging electric cars, which includes a battery that can store energy and enable electricity supply even during peak hours. The system supplies electricity to a shared parking lot of four buildings in the neighborhood. EV-Aya financed the expansion of the electric company's connection to the building, and set aside charging stations made by EV-Meter, but it added to the system a component that does not exist in the competing companies - a small 15-kilowatt battery. The battery, manufactured by BYD, will be able to store electricity during off-peak hours, when there is no demand for charging in the building, and supply it during peak hours, in the evening for example, when car owners return to the building and ask to charge them.