Monthly Review January 2023

February 20, 2023

Preface – Economic Climate

The Israeli economy is an advanced economy that belongs to the OECD organization. The GDP per capita is $52,947, and the growth rate in 2022 is estimated at 6.5%.

Israel is recovering from the Covid-19 crisis, which has significantly affected the Israeli economy since 2020. The deficit in February 2022 – January 2023 is negative -0.3% from the GDP. The debt-to-GDP ratio is 60.2%. The unemployment rate is 4.2%.

At this stage, it is difficult to say how the election results will affect the Israeli economy. On the one hand, the new government entails a promise of stability that will allow an orderly transfer of the budget for the coming years; on the other hand, the promotion of legal reform may create instability in the markets and a loss of confidence in the legal system and its ability to guarantee the property rights of investors from Israel and abroad.

Furthermore, the entry of the religious parties into the coalition may create pressure for a significant fiscal expansion which may increase the primary deficit and delay necessary reforms in the labor market.

Along with economic stabilization and rapid growth, there has been an increase in the inflation rate. As of January, the annual rate is 5.3%. The Chief Economist in the Ministry of Finance predicts that in 2023 the inflation rate will be 2.7%.

From a monetary point of view, the Bank of Israel is dealing with the rise of inflation. In January, the interest rate was raised to 3.75% due to the increase in inflation.

Statistical Profile

Society

Population (December 2022): 9.662 Million

Economy

GDP per capita: $52,947

Inflation (January 2023): 5.4% Annual Growth Rate

Current Account Balance (Q3 2022): 3.55% of GDP

Trade in Goods and Services (January 2023): $ 13.9 billion

Finance

US Dollar Exchange rate (January 2023): NIS 3.45

Euro Exchange rate (January 2023): NIS 3.71

Long-term interest rates (January 2023): 3.34% Per Annum

Short-term interest rates (January 2023): 3.64% Per Annum

Government

Debt to GDP ratio: 60.2%

Deficit to GDP (February 2022 to January 2023): -0.3%

Motorization

Level of Motorization (2021): 406 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2022): 4.8% of GDP

Environment

CO2 Emissions (2022): 8.38 Tonnes Per Capita

Jobs

Employment Rate (Q4 2022): 68.95% of Working Age Population

Official Unemployment Rate (December 2022): 4.21% of the Labour Force

New Cars and CV Registrations

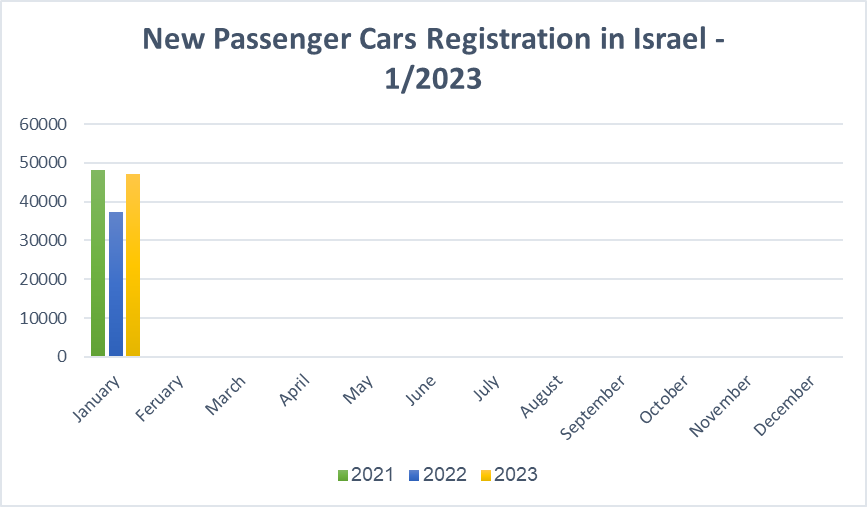

New Passenger Car Registration: Jan 2023

Passenger car registration: an increase of 26.2% compared with January 2022.

Strong start: in January 2023, the Israeli passenger car market registered 47,196 new cars – an increase of 26.2% compared with 37,404 registrations in January 2022.

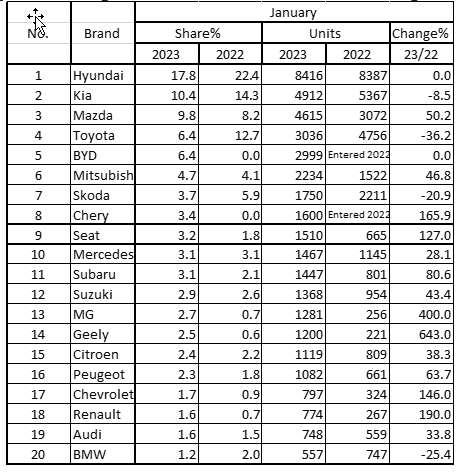

New Passenger Cars Registration According to Brands: Jan 2023

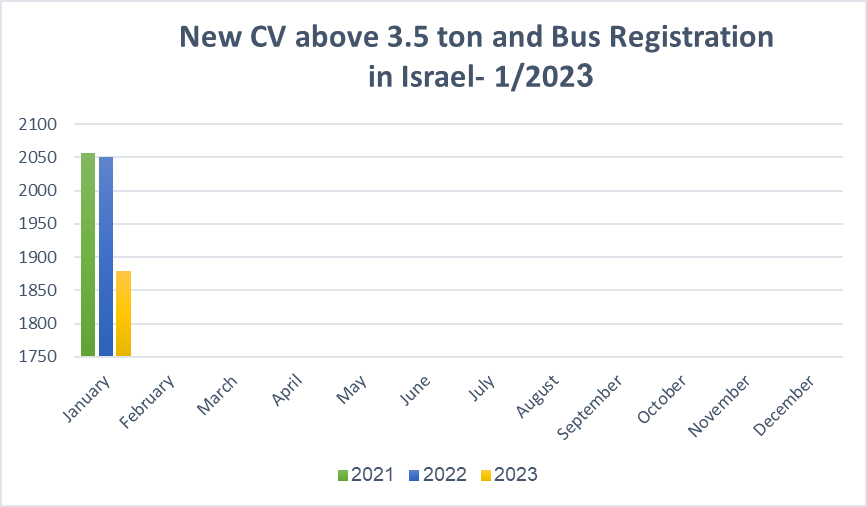

New CV above 3.5-ton Registration: Jan 2023

Commercial Vehicles above 3.5-ton registration: -8.4% compared with January 2022.

In January 2022, the Israeli market for CVs above 3.5 tons registered a decrease of 8.4% with 1,879 new registrations, compared with 2,051 units in January 2022.

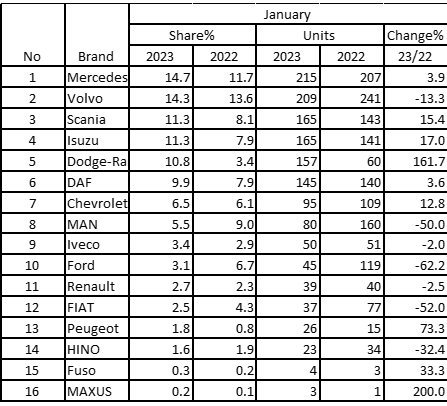

New CV above 3.5-ton Registration According to Brands: Jan 2023

New Bus Registration According to Brands: Jan 2023

Israel's Auto and Auto-Tech industry

CATO Networks Partners with TAG Heuer Porsche Formula E Team

Israeli Cyber-security company CATO Networks is TAG Heuer Porsche Formula E team's official SASE partner. CATO will play an essential role in helping the Formula E Team to optimize operations and provide secure access to the network and SaaS applications during the racing season. To do so, CATO will provide its single-vendor SASE cloud platform.

Ottopia Completes Round A, Raises 14.5M$

Israeli startup Ottopia, specializing in remote monitoring of autonomous vehicles, announced the completion of Round A, in which 14.5M$ were raised from transportation giant ComfortDelGro and VC funds such as MizaMaa, AI Alliance, and In Venture, among others. The company, founded in 2008, provides remote monitoring services for autonomous vehicles in transportation, agriculture, mining, shipping, and logistics.

Apollo Power Inaugurates Apollo-Carmel Plant

Apollo Power, an innovator in the field of solar energy and creator of the flexible and light Apollo Energy-film, announced the inauguration of its new plant for flexible solar sheets. The new plant, the first automatic of its kind worldwide, includes two main buildings totaling 10,000 square meters. Building it took 18 months and cost approximately 100M NIS. The company recently completed an installation of a solar pavement at an Amazon logistics site in France and also received an order to provide solar sheets for the roof at the same place.

EVR Motors Signs Commercial Agreement with Indian RSB Group

EVR Motors, a developer of advanced electric motors for transportation, signed a commercial agreement with Indian Tier-1 supplier RSB Group. According to the agreement, EVR will develop, manufacture and market a line of electric motors for LCVs. EVR has already signed contracts with other companies, such as EKA Mobility, and the new agreement will help the company expand its line of innovative “Trapezoid Stator” motor topology.

Electric Revolution in Israeli Public Service Fleet

Starting from January 2023, the Israeli public service will stop purchasing ICE cars, and within two years, the whole public service fleet of about 15,000 vehicles will shift to EVs. In addition to the environmental benefits, the shift is estimated to save hundreds of millions of NIS annually in fuel and maintenance costs.

Trucknet Signs Agreements with PTV Group and FBF

Trucknet, the developer of an optimization platform for freight companies, signed an exclusive reseller agreement with PTV Logistics, a leading global software company for planning, calculating, and optimizing transport logistics. Trucknet will embed PTV’s mapping solutions in its’ platform in Israel and will also act as

an exclusive reseller for PTV’s mapping system, an alternative to WAZE and Google Maps. Trucknet also announced that it had signed a memorandum of understanding with American FBF (Florida Beauty Flora), according to which Trucknet’s platform will be installed in FBF’s 250 trucks fleet, and FBF will collaborate with Trucknet for marketing its’ platform in the US and possibly even invest in the company.