Major Automotive Global Trends - February 2023

March 9, 2023

Global

The conflict over gaining control of the world’s Lithium reservoir between auto manufacturers and mining companies intensifies

As auto market growth accelerates, so does the business conflict between different players over Lithium reservoirs and purchasing companies licensed to mine the mineral, so precious to the auto industry.

The conflict is between states, industrial companies, and auto manufacturers operating directly in this realm. On February 18th, Bloomberg reported that Tesla is also looking to short-cut the Lithium supply chain and acquire a Canadian company that develops Lithium mines. The company holds, among other things, the rights for mining in Brazil, which has one of the largest Lithium reservoirs in the world.

At the same time, Reuters reported that Tesla signed a long-term supply agreement with Australian mining company Manis Energy. The same company also intends to inaugurate a new plant for Graphite processing, another vital material for EV battery production, and supply Tesla with it for three years, beginning in 2025.

Tesla is just one of the companies racing to reserve the materials directly from the producers. GM also announced its intention to invest 650 M$ in acquiring ownership in a Canadian mining giant. The Lithium amounts the company aims to produce will enable GM to manufacture 700,000 EVs a year, starting from 2026.

Ford also signed an exclusive supply contract with a large Australian mining company, and so did Stellantis – and these are just a few examples.

Auto manufacturers are competing directly against battery manufacturers from China and Korea and also against large mining and chemicals companies that are troubled by the auto industry’s direct procurement track.

According to recent data, the global demand for Lithium processed to EV battery level, which stood at 600,000 tons last year, is expected to climb up to 1.29 million tons by the middle of the decade and up to 2.18 million tons by the end of it.

Global sales keep recovering in February, but Eastern Europe is “dragging” the numbers down

Global deliveries for passenger cars are expected to increase in February. Still, East Europe is “dragging” the numbers down, so reveals a preliminary forecast by LCM Automotive consulting firm published in late February. According to the company’s data, February sales are supposed to be 7% higher than last February's; however, the yearly rate is still under 80 million passenger cars, reflecting a slowdown compared with January.

The most negative sales figures, dragging the rest of the numbers down, come from Eastern Europe, mainly Russia, and Ukraine, with a 22% decrease.

The company’s current forecast for 2023 is an increase of 6% and global sales of 85.9 million passenger cars. The company states that there are still uncertainties, but markets are durable, and the world’s major economies are tackling quite well, so car sales are expected to get back on track.

Source: LMC Automotive

USA

American auto market keeps recovering in February, but private demand is still at a relatively low

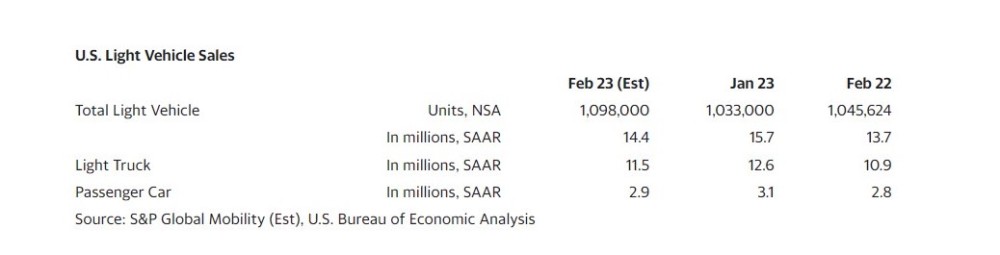

New car deliveries in the US market in February are expected to come down to 1.1 million units, an increase of 5% compared with last February. This figure also represents an increase of 6% compared with January and seven months in a row of growth in deliveries, so reveals the preliminary monthly forecast published by S&P Global Mobility.

However, the company estimates that growth in sales is primarily the result of improved production volumes and is not enough to testify to a change in trend as far as demand for new cars. The company calculates that the yearly sales rate is currently at 14.4 million units, quite far from the 2019 record.

Analysts point out that the increase in sales stems mainly from a gradual recovery in sales for fleets, which suffered substantially over the past two years, and now their relative part in overall sales is growing. They claim this phenomenon testifies to the economic uncertainty private US customers face.

The forecast shows that production volumes keep recovering at a respectable pace. By mid-2023, inventory surpluses may reappear, bringing back to life the sale promotions and discounts and contributing to lowering the average unit prices, which will, in turn, stimulate private demand.

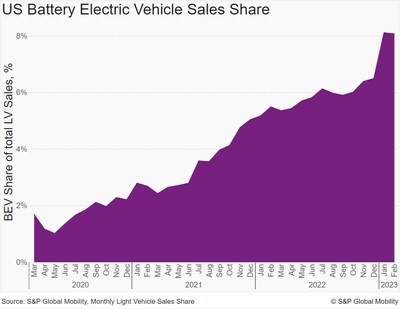

The company forecasts that the demand for EVs will continue throughout 2023, among other things, thanks to sharp price drops made by Tesla and Ford, which already stimulated demand and broke sales records.

According to the company’s estimates, the EV market share rose to a record 8% in February. Analysts still cannot assess whether the moves by these companies will create a “Price war” in the US EV segment. The reaction to the competition will determine if this is a temporal change or a far-reaching trend.

US administration continues softening tax policy that discriminates foreign EV manufacturers

The US government IRA (Inflation Reduction Act) was recently moderated when the administration added a “Back door” in the form of a section enabling foreign EV manufacturers (that produce EVs outside of the US) to keep receiving federal subsidies as long as they are selling to “Commercial customers”, including leasing companies.

However, the US trade partners are not satisfied with that and demand European manufacturers regain the total subsidies to compete in the US market on equal terms. That was also the goal of the upcoming trip to the US announced in February by the EU’s vice president of trade, Valdis Dombrovskis.

The meeting, scheduled for the beginning of March with high-ranking officials from the American administration, will focus on the EU’s attempt to convince the US administration to give the 7,500$ subsidy to European EVs sold to private customers as well. According to the senior European, “The US expressed openness to finding ways to treat us as equal partners in the free trade agreements… We managed to resolve some of the problems created by the IRA, but not all of them”.

According to him, the progress reached vis-à-vis the US is in the definition of “Commercial vehicles” to give the subsidy. “This puts us halfway towards a satisfying solution regarding the tax benefits for private EVs,” he said.

The meeting comes from repeating warnings by large European auto manufacturing countries, saying that unless the US withdraws from its’ discriminating policy, Europe may adopt a similar one, granting advantages to local auto manufacturers.

At the same time, some European manufacturers are looking into other alternatives in case the political channel doesn’t deliver the desired results. On February 21st, BMW announced that it intends to substantially widen its production activity in Mexico with an investment of 1B$ and open a new plant for producing “A new category of EVs” within a few years. The move to Mexico is the result, among other things, of the agreements between the US, Canada, and Mexico, allowing vehicles manufactured in these states to be considered “American” for IRA purposes. Also, cheap manufacturing in Mexico will enable premium manufacturers such as BMW to produce more affordable EVs. Their retail price will be under the maximum price for vehicles eligible for tax benefits. At the same time, Audi announced that it intends to open a production plant for EVs in the US to enjoy IRA benefits.

Victory for US auto manufacturers: the administration softens the definition of “SUV” for EV tax benefit purposes

The pressures on the US administration to “Soften” the requirements for EV tax benefits come not only from the outside but also from home, and they are bearing fruit. At the beginning of February, the US treasury changed the definition of “SUV” to make more models eligible for the tax benefit.

Before the change, several EV models manufactured in the US, including Tesla Model Y, were not considered “SUVs” and thus were regarded as Private Passenger” EVs that are entitled to tax benefits only if they cost up to 55,000$.

This threshold left out quite a few models and versions that were more expensive and weighed below the weight bar that defines a “SUV”. However, following the new definition, these models and versions will now be described as SUVs and entitled to the tax benefit if their price is up to 80,000$ and not 55,000$.

The change is the result of the pressure applied by American auto manufacturers. The American auto industry congratulated the difference, but American environmental organizations, on the other hand, expressed concern. They claim that using the environmental agenda, the government is promoting the sale of large, hulky, and very heavy EVs, whose energy consumption is high, and so is their environmental signature (determined by their electricity consumption and contribution to congestion), which is considerably higher than those of “Reasonable” EVs.

Tesla’s global discount initiative continues to shake up the industry

It’s been almost two months since Tesla came out with its’ global discount initiative that lowered Tesla car prices sharply, and the auto industry is still unsettled. In the middle of February, Luca de Meo, CEO of the Renault group, was interviewed for the Financial Times and severely criticized “Tesla’s frenzied price policy”. According to him, this initiative hurts the value of EVs for all customers in the market, and the price fluctuations also hurt the trust customers have in their car's value retention in the long run.

Apart from Ford, which dropped its’ EV prices in the US, no other western auto manufacturer of substance made such a strategic price drop as of the end of February. Auto manufacturers claim that given the current cost structure of raw materials and batteries, there is pressure to raise prices and not drop them.

In February, young EV manufacturers in China made significant price drops, primarily those traded in the stock exchange, since their stock is affected more by sales volumes and less by profitability. Therefore, they had to respond to Tesla’s move. Tesla’s move had the most substantial effect on the US market, which is now changing due to price drops. According to an analysis made by Bloomberg’s research division, published in late February, the price of a Tesla 3 in the US is now lower by thousands of dollars from the average deal price for new cars in the US, including petrol models. The cost of a Tesla Y, which dropped by almost 12,000$ (including the 7,500$ federal tax benefit), is now close to the average price of a new petrol car.

Morgan Stanley analysts point out that the shift between ICE petrol cars and EVs, caused by Tesla’s price drop, was made possible, among other things, due to the sharp price increase of petrol cars in the US, whose average deal price climbed more than 10,000$ since the end of 2019 to 47,000$. In addition, petrol cars are not eligible for the 7,500$ federal tax benefit given to EVs in the US market.

US administration publishes a list of terms to receive subsidies for establishing charging stations

The Baiden administration continues to swiftly promote the program to accelerate EV penetration in the US. In February, it published the demands for those who wish to receive government funding for charging infrastructure.

As recalled, the government approved last year a budget of 7.5 B$ for establishing charging stations across the US. The primary condition is that the station will support CCS quick charging standard, which is globally common.

Also, only stations built physically in the US will be eligible for subsidies. From 2024 onwards, only stations that at least 55% of their components are made in the US will be eligible for funding. This term may block many Chinese suppliers currently leading globally in producing parts and charging stations.

Another requirement is a simple and uniform payment method, i.e., the possibility of paying using a credit card with no need for designated apps or magnetic card readers. Another requirement is for simple and uniform operating technology, very much like in gas stations.

The ultimate goal of all these subsidies is to deploy at least 500,000 public charging stations by the end of the decade, and commercial companies, cities, districts, etc., can apply for funding. As part of the initiative, the administration announced this February that Tesla agreed to open its private charging network across the US to owners of non-Tesla EVs for a charge.

China

The Chinese government will forbid auto manufacturers from selling their production license to a third party

The Chinese government is readying to implement a new comprehensive and competitive reform for its’ auto industry. Chinese press reports that as part of the reform, the government will not allow auto manufacturers that are facing difficulties to sell their government-issued car manufacturing license to third parties, but only to cancel it. It should be noted that in recent years there have been quite a few instances in which auto manufacturers turned their license into an “Asset” that can be traded with younger and more affluent companies that don’t have a production license. This phenomenon contributed to the rise of many new auto brands, some of them financially weak, and increased the competition and the risk in the Chinese market. The last brands that received a special permit to acquire third-party production licenses and facilities are NIO and, recently also, XIAOMI.

According to the report, the government also intends to ban new manufacturing licenses in the future completely. The meaning is that large initiatives in the Chinese auto industry, some of them already spent capital in establishing companies and recruited investors, may face a dead-end or remove manufacturing to other countries. It should be noted that large industrial contractors in Taiwan, such as FOXCON, have already signed agreements to manufacture vehicles for Chinese companies. Another result is that existing and struggling auto companies that are publicly traded may take a severe blow since their manufacturing license can no longer be considered an asset.

A new “Chip crisis threatens China”, this time due to international sanctions

The global auto industry is gradually freeing itself from the chip crisis that hurt manufacturing in recent years, but China is entering its own “Chip crisis”. The reason is the expansion of international sanctions that prevent equipment allocation for advanced chip manufacturing from the west to China. The sanctions began in the US as part of the Baiden administration’s attempt to prevent Chinese technological supremacy.

In response, the Chinese semiconductor industry association published a protest letter expressing its objection to the action that “Demolishes the existing ecosystem of the global chip industry, violates free trade agreements, and disrupts the balance between supply and demand”.

The Chinese claim that the Chinese chip industry is a global entity, employing hundreds of thousands of workers in facilities worldwide. Any step designed to harm it will cause “Unimaginable damage” to the lives and livelihood of many people globally, not just in China.

It is still unknown what effect the boycott on the Chinese auto industry will have. Still, according to estimates, it may foster the advancement and production of “Smart” vehicles that incorporate advanced AI chips, and their supply relies on the domestic industry.

South Korea

Koreans are starting to deploy a new method for marking and comparing the efficiency of EVs

The swift shift to EVs in developed markets left baffled many consumers to the lack of reliable comparative data on EVs besides their formal technical specifications. South Korea is one of the first countries committed to developing relative consumer regulations that will present the energetic efficiency of EVs on a comparative and objective basis.

This June, a new binding regulation will take effect demanding that EV producers and marketers add a sticker rating the car’s efficiency, similar to the method used for ICE cars. The complex part was developing an accurate and easy-to-understand index. To that end, South Korea developed an index with five efficiency levels according to electricity consumption that is measured by Km/kWh. Level 1 is the most efficient (5.1-5.8 Km/kWh), while level 5 is the most “Wasteful” (3.4 Km/kWh and below). A preliminary examination of Korea revealed that less than 20% of new EVs sold in Korea belong to economic level 1. In addition, the new regulation will mandate the presentation of battery charging efficiency.

Europe

Analyst forecast for 2023: the European auto market will recover, but still almost 30% less than 2019 figures

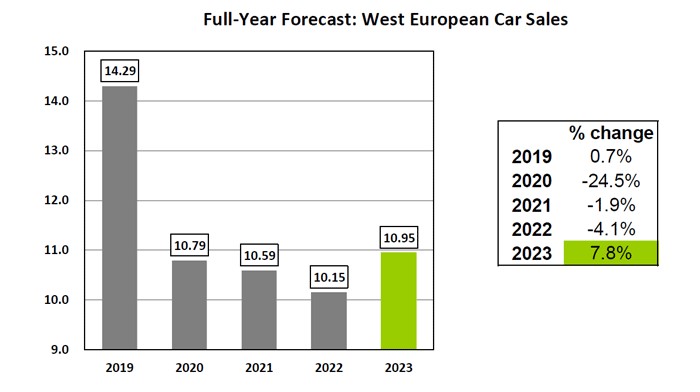

The European auto market is expected to recover this year and register 10.95 million units – an increase of 7.8% compared with 2022. However, the figures are still likely to be almost 30% lower than pre-COVID 2019, so claims the yearly forecast made by LMC Automotive. The company estimates that production volumes will still be limited this year, although less than last year.

As far as macro conditions, the company expects the continuation of inflation pressures in western Europe that shrink the household’s income and provide negative motivation for car purchasing. However, long waiting lists, some from last year due to inventory shortage, are supposed to “Cushion” some of the negative influences.

AlixPartners research firm estimates that the auto industry still carries a massive “Hump” of loans and credit lines from the height of the COVID crisis between March and May 2020. The additional debt the manufacturers are facing is estimated at 72 B$, and according to the research firm, it will continue to weigh on the auto companies for years and will cause them to reduce expenditure on R&D.

Due to that debt, analysts have decreased the auto industry’s investment forecast for shifting to EVs until 2024 by 34 B$. The company’s researchers claim that almost all manufacturers must deal with cost structure problems. That will catalyze more and more M&A in the auto industry, similar to those that created Stellantis. The firm estimates that since the beginning of the COVID crisis, the auto industry lost a production volume of 36 million units due to supply chain disruptions.

Future EURO 7 regulations continue to create headlines

The new EURO 7 regulations are nearing the decision point, and criticism from the auto industry towards them is increasing. In February, the CEO of Stellantis, Carlos Tavares, declared that future emission regulations, especially those relating to NoX and CO, are useless.

According to him, the EU’s regulation that will ban the sale of ICE vehicles starting from 2035 causes auto manufacturers to align for shifting their production to EVs. Therefore, the new EURO 7 regulations will force manufacturers to allocate vital resources from EV development to an expensive upgrading of ICE production for a short interim period. He claims that these regulations will also “Push out of the market” cheap models that their production will be unaffordable. Tavares added that EURO 7 regulations are unhelpful, the standard they set is too high, and they are not beneficial to the environment.

The president of Renault, Luca de Meo, appointed as the new president of the ACEA this January, was also critical of the new EURO 7 regulations. In his first speech as ACEA president, he said they would cause the closure of European factories. He states, “The whole European auto industry is at a crossroads, as manufacturers are facing pressure from regulators and also from Chinese and US competitors that are enjoying favorable tax policy. Instead of forbidding (production of ICE cars from 2035) or regulating as in Europe, the governments in China and the US are concentrating on invigorating the domestic industry”.

He also called for the EU to revisit the formulation of an answer to the American IRA that discriminates against European manufacturers and favors local auto companies. According to him, EURO 7 regulations will not contribute to decreasing CO2 emissions, and compliance with them will cost the manufacturers almost 1,000 Euros per unit and much more to the end customers. He assessed that the resulting price increase would hurt new European car sales by 7-10%.

Additional European manufacturers announce a shift from marketing via dealers to direct marketing

The trend of shifting to a “Direct marketing model” for new cars instead of using a dealers network keeps expanding in Europe. At the end of February, Mercedes started deploying the latest model in Germany, and their customers were directed to buy and pay for their cars directly from Mercedes. The dealers will concentrate from now on physical delivery and providing services.

So far, a few of Europe’s largest automakers have announced that they intend to adopt the new model in the next 2-3 years. On the other hand, other manufacturers declared that they are continuing with the existing marketing model by giving marketing franchises to independent dealers.

Mercedes claims that shifting to the new model will enable it to reduce distribution costs, prevent price increases and strengthen customer confidence. This model will also allow the company to increase profitability.

New research: accelerated penetration of Chinese EV manufacturers will also lower petrol car prices

The accelerated penetration of EVs to Europe may push down not only European-made EV prices but also car prices in general, to the estimator COX research firm in its’ review published at the end of February. The company estimates that the competition from Chinese EV producers will increasingly pressure local manufacturers in Europe in the coming years, driving down both ICE car prices and overall profitability.

The company said that China’s advanced battery development and production technologies allow the Chinese to manufacture EVs at a cost lower by 10,000 Euros than their European counterparts and gain a significant cost advantage. COX writes, "At the moment, the retail price of Chinese brands is not significantly lower than those of European or American brands, but they offer better equipment and ADAS for which the Europeans and Americans charge extra”. The company estimates that if the flood of Chinese vehicles to Europe continues, the EU may respond with protective custom taxes to defend European production.

The EU parliament gives final approval to banning the sale of ICE vehicles in Europe from 2035

In mid-February, the EU parliament approved banning the sale of ICE vehicles in Europe from 2035. The vote was divided and finally determined by 340 votes for, 279 against, and 21 abstained.

Supporters of the decision claimed that it would provide the auto manufacturers with a clear time frame during which they could move in an orderly fashion from producing ICE models to EVs, allocate the required funding and align with the increasing competition from the US and China. It has also been claimed that this move will enable Europe to reach its ultimate goal of “Obtaining environmental neutrality by 2050 with zero greenhouse gas emissions”.

Frans Timmermans, vice president of the European Commission and a supporter of the ban, warned parliament members that: “By the end of the year, China will market no less than 80 EV car brands… these are good cars that are cheaper, and we need to compete with that. We cannot abandon this vital domestic industry to foreign players”.

On the other hand, those in parliament who oppose the ban claimed that neither the industry nor the customers are ready for such a dramatic halt in ICE production and that hundreds of thousands of jobs are at risk. They claim that “The market should decide which technology is better and move at its’ own pace”. In this context, it was mentioned that 600,000 people are employed in ICE car production and related areas in Germany alone, and these jobs are now at risk. The opponents also warned against what they called “The Cuba effect”, meaning that many Europeans will continue to drive old and polluting petrol and diesel models long after 2035 since they won’t be able to find or afford a new EV.

Updated forecast: close to half of all cars manufactured in Europe this year will be electrified to some level

The EU countries are expected to manufacture almost two million BEVs this year, and nearly 50% of all vehicles manufactured in Europe in 2023 will have an electric drive to some level, including hybrid and mild-hybrid, so reveals a report ordered by the European association of automotive suppliers (CLEPA) and published on February. According to the report, vehicles that can move using electricity only, such as EVs and PHEVs, will account for 21% of production, compared with 17% in 2022. The report estimates that by 2027, BEV market share will be larger than any other drive systems manufactured in Europe. However, the association warns that only 3% of the investment required to develop adequate raw material processing and battery industries was invested out of the 131 B$ estimated investment volume.

SOURCE: LMC AUTOMOTIVE

Israel

A new ministry of finance position paper claims: that tax benefits for EVs in Israel are too high. Taxation must be increased

The scope of tax benefits for EVs in Israel reaches 0.38 NIS per Km, so it reveals the calculations made by the ministry of finance and publishes this February as part of a new position paper. The estimates are based on the purchasing tax benefit when buying the EV, a reduced license fee, and a de-facto exemption from excise tax. According to the calculations made by the ministry, these represent savings of 69,000 NIS over 14 years of using a typical car. The paper also claims that the sum of the tax benefits given to EV buyers is significantly higher than the average and European median. The ministry’s economists believe that these figures justify lowering the gifts given to EV buyers and owners.

The writers of the position paper claim that: “As long as the EV market was in its infancy, the justification for the benefits was the will to provide it with infant industry protection, while macro influences of these benefits were marginal. As the penetration rate grows, a balanced policy needs to be formulated that, on the one hand, will continue to remove regulatory and infrastructure obstacles that prevent EV penetration and also express the environmental benefits of EVs appropriately, but on the other hand, will prevent the creation of incentives that will result in a growing reliance on private transportation and cars”.

However, experts point out that the ministry's calculations are wrong in not considering additional and significant costs over the life of an EV that are not typical of ICE cars. Among these is the cost of replacing the battery, an expendable component that needs replacing at least once over 14 years. Presuming that the battery cost will continue to represent a large share of the car’s price, estimated at over 10,000$, significant incentives are still required to achieve balance.