Monthly Review February 2023

March 21, 2023

Preface – Economic Climate

The Israeli economy is an advanced economy that belongs to the OECD organization. The GDP per capita is $51,249, and the growth rate in 2022 is estimated at 6.5%.

The deficit in March 2022 – February 2023 is negative -0.2% from the GDP. The debt-to-GDP ratio is 61.1%. The unemployment rate is 4.3%.

At this stage, it is difficult to say how the election results will affect the Israeli economy. On the one hand, the new government entails a promise of stability that will allow an orderly transfer of the budget for the coming years; on the other hand, the promotion of legal reform may create instability in the markets and a loss of confidence in the legal system and its ability to guarantee the property rights of investors from Israel and abroad.

Furthermore, the entry of the religious parties into the coalition may create pressure for a significant fiscal expansion which may increase the primary deficit and delay necessary reforms in the labor market.

Along with economic stabilization and rapid growth, there has been an increase in the inflation rate. As of February, the annual rate is 5.2%. The Chief Economist in the Ministry of Finance predicts that in 2023 the inflation rate will be 2.7%.

From a monetary point of view, the Bank of Israel is dealing with inflation's rise. The interest rate was raised to 4.25% due to the increase in inflation.

Statistical Profile

Society

Population (January 2023): 9.679 Million

Economy

GDP per capita: $51,249

Inflation: 5.2% Annual Growth Rate

Current Account Balance (Q4 2022): 4.02% of GDP

Trade in Goods and Services (February 2023): $ 13.268 million

Finance

US Dollar Exchange rate (February 2023): NIS 3.54

Euro Exchange rate (February 2023): NIS 3.79

Long-term interest rates (February 2023): 3.31% Per Annum

Short-term interest rates (February 2023): 3.89% Per Annum

Government

Debt to GDP ratio: 61.1%

Deficit to GDP (March 2022 to February 2023): -0.2%

Motorization

Level of Motorization (2021): 406 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2020): 5.44% of GDP

Environment

CO2 Emissions (2022): 8.38 Tonnes Per Capita (BDO Model Estimation)

Jobs

Employment Rate (Q4 2022): 68.95% of Working Age Population

Official Unemployment Rate (January 2023): 4.34% of the Labour Force

New Cars and CV Registrations

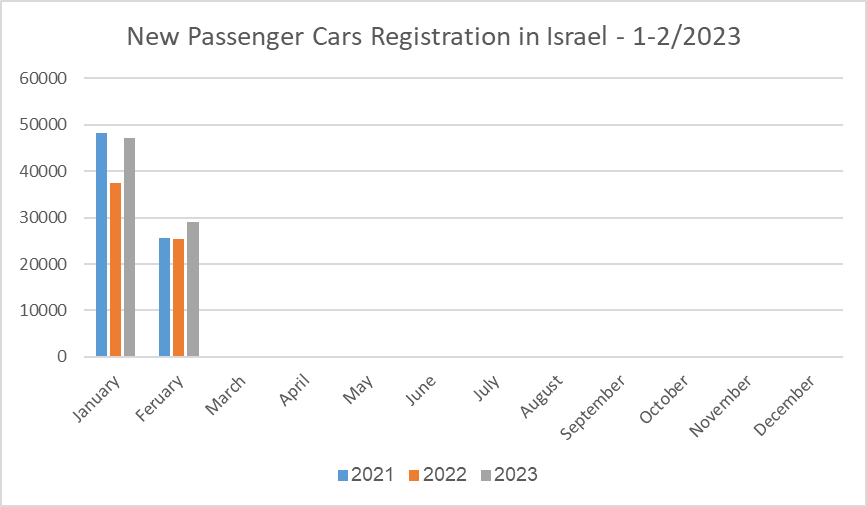

New Passenger Car Registration: Jan-Feb 2023

Passenger car registration: an increase of 15.2% compared with February 2022.

In February 2023, the Israeli passenger car market registered 29,132 new cars – an increase of 15.2% compared with February 2022. Since the beginning of the year, 76,328 new cars were registered, an increase of 21.7% compared with Jan-Feb 2023. During these months, 10,923 EVs were registered, representing 14.3% of all registrations.

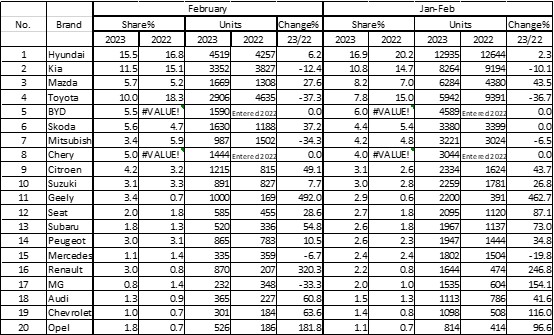

New Passenger Cars Registration According to Brands: Jan-Feb 2023

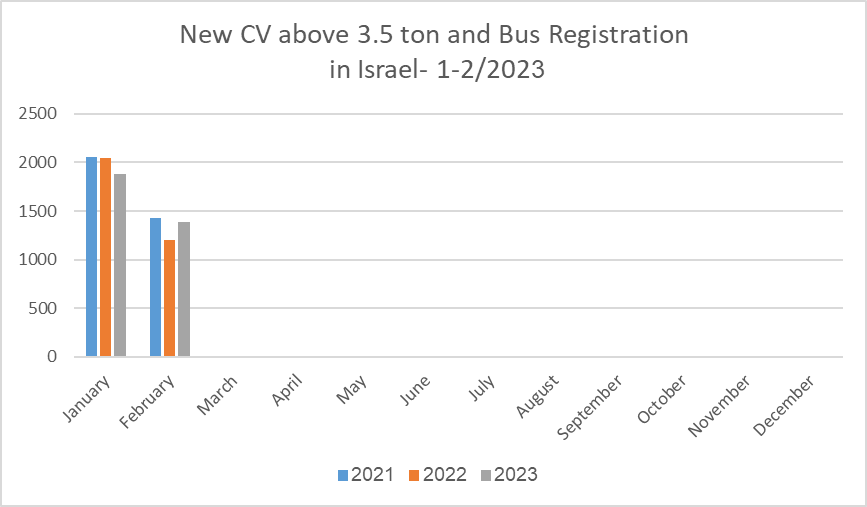

New CV above 3.5-ton Registration: Jan-Feb 2023

Commercial Vehicles above 3.5-ton registration: +15.9% compared with February 2022.

In February 2022, the Israeli market for CVs above 3.5 tons registered an increase of 15.9% with 1,388 new registrations, compared with 1,198 units in February 2022. Since January, 3,267 units have been registered, a rise of 3.9% compared with Jan-Feb 2022.

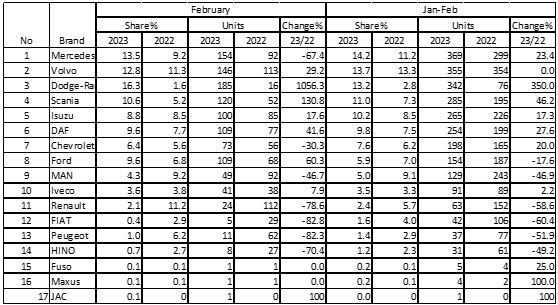

New CV above 3.5-ton Registration According to Brands: Jan-Feb 2023

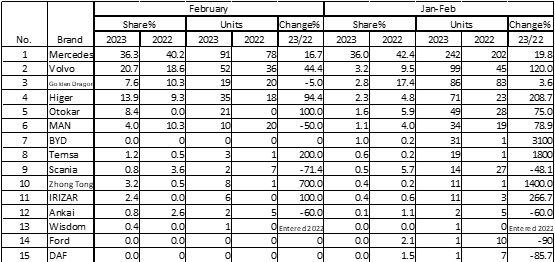

New Bus Registration According to Brands:Jan-Feb 2023

Israel's Auto and Auto-Tech industry

HARMAN Collaborating with ProteanTecs

ProteanTecs, an Israeli company founded in 2017 to develop deep data analytics for monitoring advanced electronics, is collaborating with Harman to advance predictive and preventive maintenance for automotive electronics. The solution developed by the two companies combines OTA technology, deep data analytics, and advanced device health monitoring to notify, predict and prevent malfunctions in the entire fleet.

C2A Security partners with Engineering Giant SEGULA Technologies

Israeli start-up C2A Security, the provider of an automotive-designated DevSecOps platform, will collaborate with engineering giant SEGULA Technologies to improve cybersecurity in the automotive chain. The two companies have decided to combine their strengths to offer car makers and mobility companies a new range of cybersecurity services, allowing them to test their vehicles’ resistance to cyber threats and to meet new automotive security regulations and standards like the WP.29 or the ISO/SAE 21434. The new partners will deploy a strategic business line across SEGULA’s 30 countries of operation, incorporating a full range of cyber risk assessment and remediation analysis solutions to easily ensure compliance with the new cybersecurity regulations, designed to support all stages of development of the automotive chain and covering all the segments of the sector, from the vehicle to the charging station.

Addionics Unveils World’s First 3D Electrode Manufacturing Pilot Line for EV Batteries

Addionics, An Israeli battery technology start-up, is launching a new state-of-the-art pilot line for manufacturing its advanced Smart 3D Electrodes™ for EV batteries. With Addionics' partners' support, the company will expand its technological developments primarily for the automotive industry, which includes leading global automakers and tier 1 suppliers. Inaugurated this February, the new site covers over 1,500 sq. ft and will serve as the company’s headquarters in addition to its US, UK, and Germany locations. It includes office space for over 50 employees, advanced laboratories, and a pilot line dedicated to accelerating the development and production of its chemistry-agnostic Smart 3D Electrodes™ technology, used to improve all key performance metrics for batteries, including energy density, power, safety, and extending lifetime – all without increasing cost. The new facility can produce up to 10kWh and will increase to about 100kWh by the end of 2024. Addionics expects to reach 1 GWh production capability during 2025.

CityTransformer Launches a 50M$ Series B Funding Round

Israeli electric vehicle (EV) startup City Transformer aims to launch production of its small urban CT-2 model in Western Europe by the end of 2024. With that aim, it is launching a Series B funding round to raise $50 million. CEO Asaf Formoza told Reuters that the company has so far raised $20 million and selected a factory in Western Europe where it will have an initial annual production of 15,000 vehicles, but has yet to disclose its location. Even though City Transformer's investors include vehicle importers and distributors, it plans to sell most of its cars directly to customers online, similar to Tesla. The start-up says it has more than 1,000 pre-orders. The company was founded in 2014 and revealed the prototype in 2017. Since then, the first production version, CT-1, was unveiled and received accolades. The CT models have a unique folding mechanism that allows them to “shrink” to a width of just under one meter to maneuver and park easily in urban environments.

ASPIRE and Electron Partner to Develop Dynamic Wireless Charging Roadway in Utah

Electron, a leading in-road wireless EV charging technology developer, and ASPIRE (Utah State University), a National Science Foundation-funded Engineering Research Center, have announced a strategic partnership to develop and operate a one-mile-long dynamic wireless charging roadway in Utah. The Utah Inland Port Authority will host the project. It will showcase the commercial feasibility of dynamic wireless charging for freight vehicles and its ability to reduce battery size, extend battery range, lower vehicle cost, and reduce grid pressure.

The project's comprehensive development and design phase is set to take place in 2023, with deployment set for 2024. The data obtained during the first phase will inform future scaling efforts, including the possibility of deploying dynamic wireless charging systems in the Salt Lake City region along the I-15 and I-80 corridors. The dynamic wireless charging system will be designed to support expansion to other regional centers, including Los Angeles, San Francisco, Seattle, and Denver. The partnership between ASPIRE and Electron follows a successful collaboration that included the deployment of a 164-foot test track of dynamic in-road wireless charging technology at Utah State

Top of Form