Major Automotive Global Trends - June 2023

July 18, 2023

Global

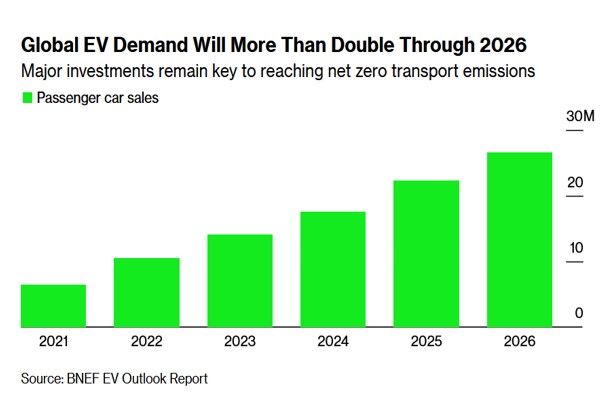

New Research: Global EV sales to double by 2026, but the road to zero-emission is still far

Global sales of EVs are expected to double by 2026 and reach 27 million, so estimates Bloomberg’s environmental research division (BNEF) in a new report published in June. However, the report questions whether the current scope of investments in the field will be enough to reach the “Zero Emission from Transportation” goal by 2050.

The researchers estimate that the Chinese and American markets will be the growth engines for global EV sales. This growth will compensate for the slow growth in Europe, resulting from a problematic supply chain and high living costs that affect the demand for EVs.

The researchers say that although the demand for ICE cars is gradually declining from the peak it reached six years ago, it will take a long time until the 1.3 billion ICE vehicles still being used disappear completely. They estimate that even in 2050, 30% of cars will be gasoline or diesel fueled, mostly in developing countries. They also predict that the demand for electric or hydrogen-heavy commercial vehicles will lag significantly behind the demand for electric passenger cars, and by 2050 only a third of heavy commercial vehicles worldwide will be zero-emission vehicles. The report states that investing in zero-emission buses and trucks should be a top priority for decision-makers.

The researchers mention that the US shift to EVs has been slow so far but that the “Green” incentive package of the Biden administration is speeding the process significantly, and the market share of EVs will triple by 2026 and reach 28%. The report estimates that the share of EVs from the total sales in the Chinese market will reach 52% by 2026, and in Europe, it will reach 42%.

According to the report, the shift to EVs is already causing a decrease in global petroleum use by 1.5 million barrels a day. Still, at the same time, there is a growing pressure to produce more and more Lithium batteries. The BNEF estimated that if no new Lithium deposits are found within the next twenty years, the Lithium supply chain will be jeopardized and will demand an increase in global investments.

The report estimates that in order to reach the zero-emission transportation goal by 2050, a global investment of 3 trillion US$ in charging infrastructure is required. The report claims that countries all around the world must significantly widen their charging infrastructure.

GlobalData: The global auto market grew significantly in the past five months

The global auto market continues to recover in May thanks to an improvement in the auto industry’s production volume, so reveals a current analysis made by research company GlobalData. The expected yearly sales rate, derived from the cumulative sales rate, was 89 million units in May, 12.3 million more than last May. Car sales in June reached 7.4 million cars, 19% more than last year, thanks to a significant increase in the auto manufacturers' productivity.

China keeps leading the growth with an increase of 26% in sales, followed by Japan at 25%, North America at 22%, and Europe at 19%. The company estimates that most of the markets will continue to demonstrate strong growth in 2023, except for the Chinese market, with yearly sales that are expected to shrink by 14%, pushing global growth down.

According to the data gathered so far, the company expects 2023 to end with 86.3 million sales – an increase of 7%. It also estimates that this year there will be a demand surplus of 3.5-4 million units that the industry will be unable to deliver due to prolonged difficulties in the supply chain. The company also warns of unexpected logistic problems, although its’ global sales projection for 2024 is quite optimistic at 90.3 million units, a 5% increase compared with 2023.

USA

Monthly deliveries projection: The American market keeps strengthening in June despite high prices and an increase in auto financing interest rates

New car deliveries in the American market are expected to continue the recovery trend showed in the past months also in June, so reveals the updated monthly sales projection made by J.D. Power.

According to the projection, 1.4 million cars were delivered in June, an increase of 22.6% compared with last June. Overall sales of Q2 are expected to amount to 4 million units, an increase of 18.2% compared with Q2 2022.

In the first half of 2023, deliveries are expected to sum up to 7.7 million units, an increase of 13.6% compared with the first half of 2022. Of these, passenger cars to private customers are expected to register an increase of 16.6%, while quarterly deliveries to private customers are expected to rise by 11.2% and the first half deliveries by 6% to 6 million units. That being said, the delivery level is still lower than that of pre-COVID 2019.

The projection attributes the two-digit growth in sales to a significant improvement in car manufacturing volumes after the “Chip crisis” subsides. As a result, dealers’ inventory levels grew to more than 1.2 million units, 45% more than in June 2022, and are supposed to stabilize around that level for most of the year. However, despite the rise in inventory, there is still no decrease in the average car price sold in the US, and in the first half of 2023, it was 3% higher than last year.

The dealer’s average profit per car keeps declining parallel to the increase in inventory, and in June reached 3,700$ per unit – 26.7% less than June last year but almost double compared with June 2019. The main reason for the profit decrease is that fewer cars were sold at a price higher than the MRSP. Average discounts are also on the rise, up to 1,800$ in June, almost twice more than June last year. The average discount from the MRSP in June was 3.7% compared with 1.7% only last June.

At the same time, the period cars spend at the dealers is increasing. In June, the cars “Sat” for 28 days on average, almost 18 days more than last year but still half the average inventory cycle time pre-COVID.

The growth in sales during H1 was also influenced by a rapid and significant increase of 54.5% in fleet deliveries, following an increase in fleet allocations by the manufacturers and the completion of long-awaited gaps in deliveries to large fleets (mainly rentals).

However, despite the positive growth, the report’s editors mention that there is still cause for concern. They state that high car prices combined with a climbing interest rate keep increasing the average monthly payment for car financing. Compared with June last year, the average household payment was higher by 4%. The average interest rate for car financing in the US was 7% in June, and US analysts are warning of a swelling “Finance Bubble” that may cause an insolvency crisis in case macro conditions worsen.

A new tax incentive policy for EVs in the US is drawing 140 billion dollars of auto manufacturers' investments

The IRA (Inflation Reduction Act) adopted by the Biden administration last year that revoked most of the tax incentives given to EVs manufactured outside the US is expected to draw to the USA 140 billion dollars in investments from the ten largest auto manufacturers in the world, so reveals new research conducted by the Japanese consultancy firm NIKKEI that was published at the beginning of June. The investments will go mainly into building new assembly lines for EVs and PHEVs and establishing battery plants in the US in order to “Gain” the tax incentives.

50% of the investments that were already declared were by the large American car manufacturers. GM, for instance, has already committed to investing 35 billion dollars in electric and autonomous vehicles and in battery plants by 2025, and Ford will invest an additional 20 billion dollars in the same areas by that year.

Japanese manufacturers Toyota and Honda are responsible for 20-30% of these future investments. Toyota has already announced a new battery plant in South Carolina that will start operating in 2025 following a 2.1 billion dollars investment. This is part of Toyota’s investment of 36 billion dollars in EVs and batteries by 2030. Honda will invest 700 million dollars in transforming three existing assembly lines in Ohio to EV manufacturing, and the company it shares with LG will invest 4.4 billion dollars in additional assembly lines. Hyundai also intends to invest in US 7.4 billion US$ by 2025; VW is investing two billion US$ in building a new EV plant in South Carolina, and so on…

Analysts estimate that according to the announced investments so far, the battery production capacity within the USA will be enough by the end of the decade for 13 million EVs and PHEVs. This number represents a third of the projected global yearly sales for these cars by 2030. The meaning is that the USA will not only be able to provide all the local demand for batteries but will also become one of the most important global centers for battery production.

However, the analysts mention that developed countries all around the world fear that the new US incentive policy will draw planned investments from them. In Europe, it is feared that this development will jeopardize the EU’s goal of reaching “Battery Supply Independence” and will cause a decrease in employment. The VW group, for instance, already announced that it is suspending the establishment of six assembly lines in Europe in favor of the US.

San Francisco becomes the “EV Capital” of the US

San Francisco is turning out to be one of the centers for “Green” and advanced transportation infrastructure in the US and perhaps in the West in general. Recent data published by S&P Global Mobility during June reveal that in March-April this year, the share of “Electrified” vehicles in the city reached 50% of total deliveries – the highest penetration rate in the USA. Specifically, in March, EV deliveries were 34.5% of total car deliveries.

The unusual numbers are attributed to the rich, young, and sophisticated population of the city, which matches the typical socio-economic profile of the American EV buyer. Namely, customers under 45 that have an annual household income of more than 75,000$. The researchers believe that high wealth accumulation in the area is also contributing to the high penetration rate. According to the data, half of EV buyers have a yearly income of 200,000$, and more than three-quarters of the residents earn more than 75,000$ a year.

China

Chinese government extends purchasing tax exemption on EVs for four more years

In May, the Chinese government announced that it is extending the exemption from purchasing tax on “New Energy” vehicles - EVs, Hybrids, and PHEVs. The exemption, which was supposed to expire at the end of the year, was extended for four more years. According to the government's data, the incentive’s worth is estimated at 68 billion US$ over the whole period.

As of today, this is the only tax benefit given to “New Energy” cars in China after all other subsidies for these cars were revoked at the beginning of 2023. However, the extended tax benefit is not limitless. According to the regulations, new cars that cost up to 41,600$ before tax and that will be purchased between the beginning of January 2024 and the end of December 2025 will enjoy a tax exemption of up to 4,000$, and in the following year, only half that. The meaning is that the incentive will be much more significant for relatively cheaper models and less for premium EVs that are currently very popular with the more affluent Chinese.

Also, not all car models will be eligible for the incentive, but only those that are approved by the government and appear in the Ministry of Technology and Standardization “Catalogue”. Car manufacturers can request to be included in the “Catalogue”, but the final decision is made by the tax authorities.

The Chinese government expects the exemption to accelerate the purchasing of new energy vehicles, which recently registered a steep decline following the cancelation of the subsidies at the end of 2022. According to estimates, this move will result in a 30% increase in EV sales in China in 2024, twice the initial estimate before the benefit was extended. In China, there is a 10% purchasing fee for all cars, and the exemption for new energy cars was first given in 2014 and since then has been renewed three times.

Senior Chinese official: “The swift growth in EV sales in China is not uniform and creates distortions”

The swift growth of the Chinese EV market creates an “Imbalance” in the Chinese auto market and requires governmental corrective steps, said during June one of the senior Chinese officials in charge of the Ministry of IT and Industry.

According to him, EV sales in China leaped from 1.36 million units in 2020 to 6.8 million units in 2022; however, their geographic and demographic distribution is problematic, and the supporting infrastructure is insufficient. He claims that there are vast areas in China, especially in the north, where there is a problem with EV batteries that are not suited to extreme cold conditions, and many car manufacturers still haven’t tackled this problem. Also, in many areas of the country, the charging infrastructure is quite thin.

The senior official also claims that penetration of electric commercial vehicles is much slower than desired. In 2022 EV sales comprised only 10% of commercial vehicle sales, and the penetration rate of electric medium and heavy trucks was 2.7% only.

The big problem, according to him, is the slow penetration of EVs in the rural areas of China, with less than 4% in 2022 compared with an average of 25.6% in China. As a result, the Chinese government is planning to push the auto industry to solve the technical problems and launch cheaper and more accessible EV models to larger audiences. Also, the government is planning on announcing a comprehensive reform regarding EV battery recycling.

South Korea

South-Korean government has canceled the purchasing tax reduction on new cars that has existed since 2018

In June, the Korean Ministry of Finance announced that starting from July next year, the reduction in purchasing tax for new cars will be canceled. The reduction took effect for the first time in July 2018 when the tax dropped from 5% to 3.5%. It was extended in 2020 following COVID in order to invigorate the slowing down Korean economy.

The official excuse for the cancelation of the purchasing tax reduction is “The strong condition of the auto industry and the improvement of the consumption conditions”. However, in Korea, it is thought that this is part of a budget cut package that the government adopted following a large decrease in tax collection due to a slowdown in the Korean economy that is evident, especially in real estate, and burdening all the business activity. In the first four months of the year, Korea registered a decrease of almost 20% in tax revenues.

Logistics problems are being solved, and car export from South Korea keeps breaking records

The release of the chip “Bottleneck” alongside a growing demand for “Green” vehicles in the Western world brought about a leap of 37.5% in car export from South Korea during May, so reveals data published by the Korean Industry and Energy Ministry in June.

The monetary value of the 250,000 cars exported in May was 6.2 billion US$, an increase of 49% compared with last May and the highest figure for this month ever. Out of the total amount, the value of the eco-friendly models, especially EVs, and PHEVs, leaped by 64% to almost a third of the total value. Compared with May last year, sales of BEVs and Hydrogen-powered cars almost doubled, while sales of hybrids grew more moderately by 11%.

The ministry mentioned that the quick rise in export was aided, among other things, by the agreement signed by South Korea and the US that excluded sales of EVs for “Commercial Purposes” from the American legislation that denies EVs that are not manufactured in the US from government subsidies. During May, the US has become the largest export destination for the South Korean auto industry with an export volume of 2.91 billion US$. Export to the EU grew as well by 31%.

According to government data, auto production in Korea climbed by 24.5% to 382,000 units in May. In the first five months of the year, 1.82 million vehicles were produced in Korea, close to 2019 pre-COVID numbers.

The Korean local auto market also saw a moderate increase in sales of 8.7%. sales of locally made cars captured 80% of total sales, while sales of imported models dropped by 14.7%.

Australia

The Australian government is looking into ways to strengthen domestic control over Lithium mining in the country

In recent years, Chinese investors discovered the massive potential for mining Lithium in Australia and invested hundreds of millions of dollars in purchasing mines and mining rights in the country. Now, the Australian government is looking into ways to deal with this situation.

At the end of June, the Australian resource minister Madelaine King said that the country must carry out a “Strategic Examination” of Chinese investments in the Australian mining industry since the two countries are direct competitors in mining and producing Lithium.

These things were said on the background of publishing the new “Critical Mineral Strategy” by the Australian government that its’ goal is to enroll partners and investors with “A Common Goal” for the mining and processing industry of Lithium and Cobalt in Australia. This is meant mainly toward Western partners that will balance the stream of Chinese investments that also have political implications in Australia. “We are competing with China in this area”, said the minister, “Therefore, it is only natural that we will want to advance our independent goals in it”.

It should be noted that Australia is the largest Lithium producer in the world today, responsible for more than 50% of the global Lithium production. The Australian government expects Lithium production in the state to double by 2028; most of it will end up in China, which is the largest processor and consumer of Lithium for EV batteries. The government has already tried to block the stream of mergers and acquisitions of Chinese companies in the state by increasing the minimal holdings of domestic companies from 9.9% to 20%.

Commentators estimate that behind this new policy is the tight contact between the Australian government and the US administration, which is looking for alternative sources of critical minerals that will lower its dependence on China. Chinese companies now have ownership percentages in a number of companies that have Lithium mining permits, and they are operating Lithium processing plants in Australia.

Europe

The European Parliament approved the “Batteries Regulation”: Within two years, battery manufacturers will have to present all the emissions related to the batteries and later on will also have to recycle batteries

On June 14th, the European Parliament approved the “Batteries Regulation” that touches on the environmental issues of planning, manufacturing, and recycling of batteries 2kW or more that are sold in Europe, mainly EV batteries. The decision was accepted by a vast majority of MPs and outlines a schedule for its implementation starting in 2026. The decision touches upon a few areas.

In the relatively short run of two years, the manufacturers will have to define the carbon footprint of the battery, publish the data and attach a QR code that will serve as a “Digital Passport” stating the CO2 emission values that are attributed to each phase of the battery’s life span, starting from extracting and processing the raw materials, through the production process and ending with the energy required to recycle the battery. The declaration of the emission values will be mandatory from mid-2024, while tagging will be mandatory from 2027.

In the longer run, battery and car manufacturers will have to recycle Lithium batteries, especially EV batteries that contain large amounts of recyclable materials. According to the regulation, at least 50% of the Lithium in each battery will be recycled starting from 2027; in 2031, it will grow up to 80%. In addition, 80% of Cobalt, Copper, Lead, and Nickel will have to be recycled by 2027, up to 90% in 2031. Finally, the manufacturers will have to use a defined number of recycled materials in the process of manufacturing new batteries, in particular Lithium, Nickel, and Cobalt.

The European parliament commission stated that: “This is a first of its’ kind ‘circular economy’ regulation that covers the whole lifespan of the product, and that attitude is good both for the environment and the economy. The final goal is to build a strong recycling industry in Europe, especially regarding Lithium. This is a key step for decreasing the dependency of the continent on foreign elements in order to complete the transition to green energy”.

Analysts estimate that beyond the environmental aspects of the new regulation, it could also have future trade and taxing implications, mainly as a basis for differential taxing on EVs and as a trade block against the Chinese auto industry in Europe. That, among other things, is due to the fundamental change in defining an EV as a “Zero Emission Vehicle” into “A vehicle that creates emissions as a bi-product of its’ production process and also while driving”.

ACEA data: the European auto market performed well in May

The European auto market kept demonstrating strong performance in May, mostly thanks to improved availability of inventory and aggressive competitive policy by the distributors. The ACEA monthly report, published at the end of June, reveals that the scope of new car sales in Europe in May stood at 11.2 million units, an increase of 18% compared with last May. This is the tenth consecutive month of increases compared with 2022. All the large five auto markets registered impressive increases, led by Italy (23%), Germany (19.2%), Britain (16.7%), France (14.8%), and Spain (8.3%).

Cumulative sales Jan-May were 5.32 million units, a 17,4% increase compared with last year but still lower than pre-COVID 2019.

EV sales continue to gain momentum and reached 170,000 units in May – an increase of 66% compared with last year. Hybrids and PHEVs deliveries rose very moderately by 0.8%. However, petrol car sales are still the most dominant in the market, with a share of 36.5% of sales compared with 13.8% for EVs. Hybrids took almost a third of overall deliveries. Since the beginning of the year, EV sales went up 42% between Jan-May with 730,000 units and a market share of 14%.

Amsterdam to partially ban ICE cars from its’ territory starting from 2025

At the beginning of June, Amsterdam joined Copenhagen and a growing list of additional cities in Europe that announced their intention to ban ICE cars from their territory, long before the EU’s “Deadline”. According to the announcement made by the municipality of Amsterdam, starting in 2025, only local zero-emission vehicles will be able to move in large parts of the city including taxis, distribution vans, scooters, boats, and more. However, contrary to Copenhagen’s sweeping ban, in Amsterdam, the regulations will not touch upon private passenger cars, and even in the relevant categories, they will apply only to new vehicles that are registered from 2025 onwards. “Transition Regulation” will apply to existing vehicles in order to gradually decrease their presence in the city. Also, the municipality is expected to grant exemptions and bonuses to disadvantaged residents that can’t afford new EVs.

The municipality intends to enforce the new regulation electronically by placing scanners for license plates in all the “Green” areas of the city that will forbid the entrance of polluting vehicles. Deviation from the rules may incur significant fines, depending on the “Green” area and vehicle types. This is an intermediate phase towards a sweeping ban on all polluting vehicles in Amsterdam beginning in 2030.

Poland to petition the European high court against the decision to ban the selling of ICE vehicles from 2035

The opposition from EU members against the EU’s accelerated environmental transportation policy is intensifying. On June 13th, the Polish minister of the environment announced that it intends to petition the EU’s high court of Justice against the decision to ban the production and selling of ICE vehicles starting from 2035.

Poland claims that the decision has been taken without an in-depth analysis of its social implications, especially for countries with salaries and standards of living that are relatively low compared with the more developed countries in the EU. Poland is not satisfied with the agreement Germany recently reached with the EU, according to which it will be permitted to sell ICE vehicles after 2035 if they use “Synthetic Fuels”. Poland claims that in countries that have a significantly lower GDP than the EU’s average, the deadline should be extended. It should be noted that despite the fact that Poland is a small player in the EU when it comes to manufacturing and selling cars, its’ announcement is receiving “Quiet Support” from other countries that may join the petition in the future.

As European countries are reducing subsidies to EVs, the Spanish government is extending them to include fleets and used vehicles

In the EU, criticism is often heard that the subsidy policy for EVs is, in fact, “A Gift for the Rich” since most EVs are purchased by customers belonging to strong socio-economic classes.

On this background, the Spanish government decided to expand the subsidies on EVs also to used cars. According to the announcement made by the government, secondhand vehicles up to 12 months old will also receive subsidies. This decision is supposed to also stabilize the EV secondhand market that still hasn’t taken off.

In addition, the new regulations state that fleets can request subsidies for purchasing new or used EVs for up to 250 cars instead of only 50. This regulation is supposed to accelerate the “Green Refreshing” of fleets and bring about a replacement of a mass of polluting vehicles with clean ones. This move is expected to increase the subsidies budget of the Spanish government by 400 million euros to a total sum of 1.2 billion euros.

According to the latest governmental subsidy plan in Spain, EVs, hydrogen-powered or PHEVs with a range of more than 90 Km, are eligible for a 7,000 euro subsidy, and electric commercial vehicles for 9,000 euros. These are among the highest subsidies in the EU today.

New customer survey in Europe: EV drivers are increasingly willing to embark on long inter-state journeys

The quick penetration of EVs in Europe is accompanied by a significant decrease in “Range Anxiety” by their owners, so reveals a comprehensive survey ordered by the charging division of Shell and published at the end of June.

The research surveyed 25,000 EV owners in Belgium, France, Germany, Italy, the Netherlands, and the UK. 42% of the respondents bought an EV in the past year and two-thirds in the last two years. 87% of them bought their car as new and the rest as secondhand.

The research reveals that thanks to the expansion of the European charging network, only 14% of the drivers said that they are avoiding long trips of hundreds or thousands of kilometers. The number of drivers that cross from country to country driving their EVs grew by 5% over last year, and the reservation from driving abroad due to “Range Anxiety” or lack of charging facilities has dropped by 7%. 47% of the respondents said that they are not charging their car every day, another indication of the decrease in range anxiety.

The research also revealed that most drivers are interested in a simple and uniform charging method that does not require different scanners/readers or apps for each different charging company. Almost 23% of the respondents said that they installed at least four apps on their phones or that they carry at least four different charging chips.

The research also found a direct connection between ownership of an EV and the personal commitment of the owners to a “Carbon Reduced” lifestyle. 47% of EV owners invested in solar panels in their homes, and 36% of them have a “Smart Home” system. However, 44% of them don’t have a private charging post.

Israel

The Ministry of the Environment is formulating a regulation for car recycling in Israel. On the agenda: placing responsibility on the manufacturers

The Ministry of the Environment is conducting comprehensive studying of the environmental implications of accelerated EV penetration into Israel. The main direction the ministry is looking into is a local implementation of a 2000 European directive (ELV-Directive) that places extended responsibility on the car manufacturers or their representatives in different countries for the “Stream of pollution” that is created when passenger cars, LCVs, and light trucks end their lives.

The goal of the directive is to reduce the trash that is being created by old vehicles while considering each phase of the life cycle of the vehicles, alongside a mechanism that assures that the decommissioned vehicle is indeed scrapped and recycled.

It should be noted that in Israel, there is separate legislation when it comes to recycling components and materials found in cars. Lithium battery recycling is handled as part of the business permit law (disposing of hazardous materials waste) 1990; other components are covered under the hazardous materials act 1996, hazard prevention regulation (used oils) 1993, etc.

However, up until now there hasn’t been a comprehensive governmental framework for dealing with car recycling that could track the vehicles at the end of their lives. It is still unclear how the recycling cost will be channeled to the manufacturers; one of the ways that is being considered is by paying an “Environmental Deposit” that will be charged when the car is sold. Using this method, it would be impossible to prevent the cost from being passed on to the final consumer.

According to the ministry’s internal assessments, a scenario of 250,000 EVs and hybrids by 2025 will result in the need to recycle over 50,000 tons of batteries by the end of the decade and a stream of additional thousands of tons each year. Currently, most of the battery recycling is done by companies specializing in the area abroad. At the same time, the ministry is also looking into the new “Battery Directive” accepted by the EU recently, but a schedule and implementation strategies have yet to be decided upon.