Monthly Review November 2023

December 24, 2023

Preface – Economic Climate

On the morning of October 7th, the State of Israel fell victim to a reprehensible and traumatic terror act that claimed innocent civilians' lives. Israel is now compelled to engage in warfare as it responds to these unprovoked and barbaric onslaughts. This conflict will indubitably impact Israel's near-term and long-term trajectory across many areas, including financial stability. Many indices are apt to shift dramatically in forthcoming assessments, as is inherent to the nature of wartime (e.g., inflation, foreign exchange rates, employment).

Therefore, updated data will be presented with minimal additions where possible.

The Israeli economy is an advanced economy that participates in the OECD organization. Israel’s GDP per capita is $53,235. The growth rate in Q.3 of 2023 was 2.8%.

Israel maintains a 3.4% deficit of the GDP from December 2022 to November 2023.

The debt-to-GDP ratio decreased to 60.9% in 2022, and the unemployment rate in November 2023 was 2.8%. As of November 2023, the annual inflation growth rate is 3.3%. In November 2023, the short-term interest rate was 4.5%, while the long-term interest rate stood at 4.3%.

Statistical Profile

Society

Population (November 2023): 9.816 Million

Economy

GDP per capita (November 2023): $ 53,235(NIS 201,920)

Inflation (November 2023) (Annual Growth Rate): 3.3%

Current Account Balance (June 2023): 4.4% of GDP

Trade in Goods and Services (November 2023): $11.36 billion ( NIS43.1 billion)

Finance

US Dollar Exchange rate (November 2023, Avg.): NIS 3.793

Euro Exchange rate (November 2023, Avg.): NIS 4.081

Long-term interest rates (November 2023): 4.3% Per Annum

Short-term interest rates (November 2023): 4.5% Per Annum

Government

Debt to GDP ratio (2022): 60.9%

Deficit to GDP (December 2022 - November 2023): 3.4%

Motorization

Level of Motorization (2022): 411 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2021): 5.557% of GDP

Environment

CO2 Emissions (2022): 8.38 Tonnes Per Capita (BDO Model Estimation)

CO2 Emissions (2021): 6.74 Tonnes Per Capita

Jobs

Employment Rate (November 2023): 62.3% of the Working Age Population

Official Unemployment Rate (November 2023): 2.8% of the Labour Force

New Cars and CV Registrations

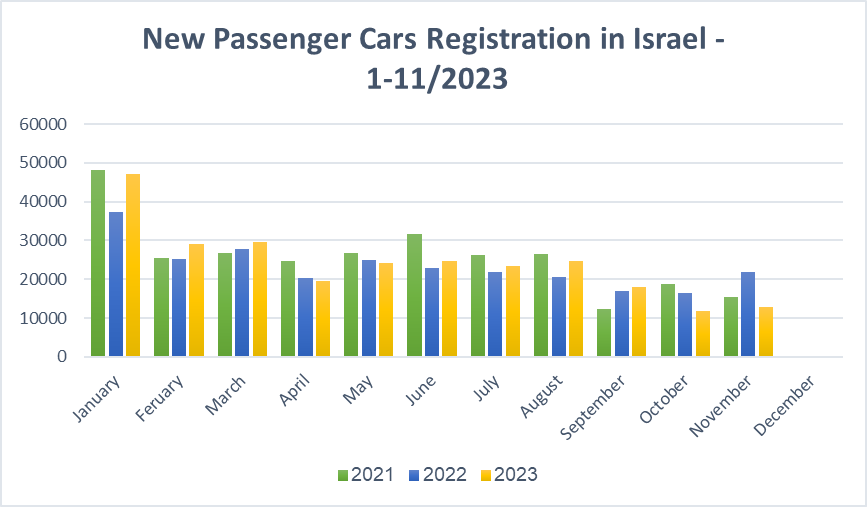

New Passenger Car Registration: Jan-November 2023

Passenger car registration: Decrease of 41.4% compared with November 2022.

In November 2023, the Israeli passenger car market registered only 12,902 new cars – a decrease of 41.4% compared with November 2022. Since the beginning of the year, 265,285 new cars were registered, an increase of 3.3% compared with Jan-Nov 2022. Since January, 46,854 BEVs and 15,020 PHEVs have been registered, totaling 61,874 cars with chargeable electric drive representing 23.3% of all registrations.

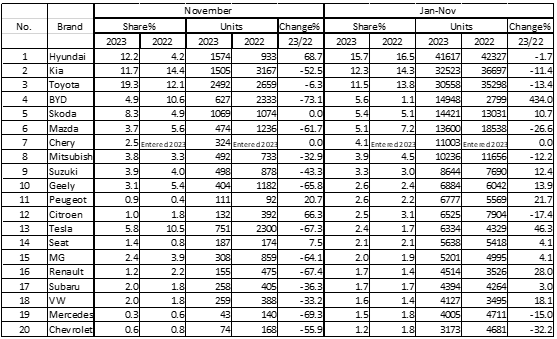

New Passenger Cars Registration According to Brands: Jan-November 2023

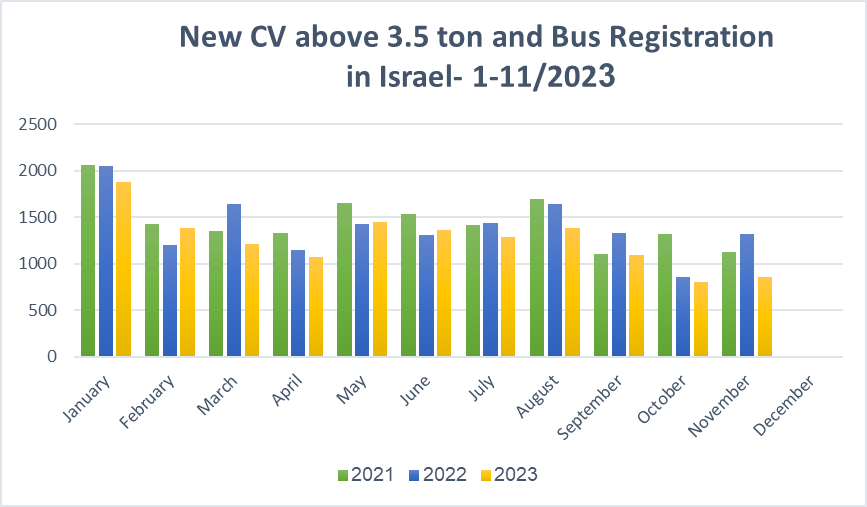

New CV above 3.5-ton Registration: Jan-November 2023

Commercial Vehicles above 3.5-ton registration: -35% compared with November 2022.

In November 2023, the Israeli market for CVs above 3.5 tons registered a decrease of 35%, with 860 new registrations, compared with 1,321 units in November 2022. Since January, 13,792 units have been registered, a decrease of 9.7% compared with Jan-Nov 2022.

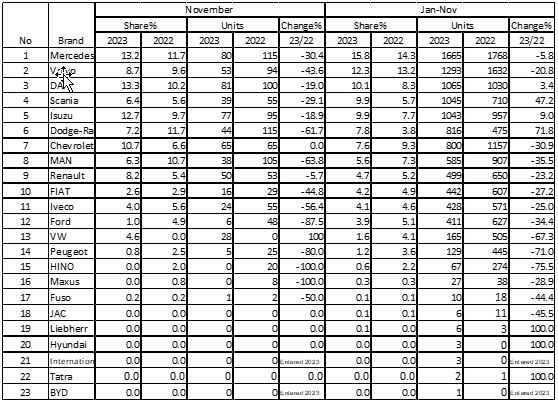

New CV above 3.5-ton Registration According to Brands: Jan-November 2023

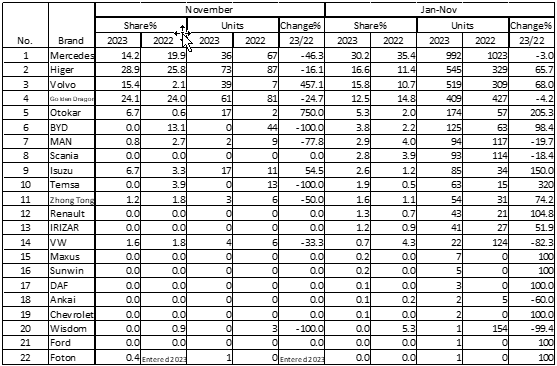

New Bus Registration According to Brands: Jan-November 2023

Israel's Auto and Auto-Tech industry

“Iron Swords” War Effects the Israeli Auto Market

New car deliveries in Israel saw a steep decline in the past two months, mainly due to the effects of the “Iron Swords” war. According to industry analysts, new orders have dropped by 30-50% compared with past years. In addition, around 80-90,000 new cars are waiting in ports to be released. These cars, many of them EVs and PHEVs, were intended to be sold to customers before the end of the year, and the expected increase in purchasing tax for EVs and PHEVs was scheduled for January 2024. The war caused a weakening of the NIS, and that increased the cost of releasing cars from customs. Another adverse effect is the postponement of new models and new brand launches planned to be introduced to the Israeli market before the end of the year. Recently, another negative factor came into play – the attacks of the terrorist Houthi militia on Israeli-owned ships that carry cars from Asia to Israel. These attacks caused delays in the arrival of ships and will cause further delays and an increase in transportation costs.

Automax to Merge with a NASDAQ Traded Company

Following its announcement at the beginning of November regarding negotiations for a merger with a NASDAQ-traded company, Automax Motors, the largest automotive parallel-import company in Israel, informed the Tel-Aviv stock exchange (TASE) that a memorandum of understanding had been signed. According to the announcement, the merger will transform Automax into a new daughter-company of the absorbing company for at least 3M$. Automax, established in 2014, holds franchises for parallel imports of dozens of automotive brands and 40% of the parallel import market for cars (which composes around 2% of the auto market in total). Parallel import imports cars to Israel, not directly from the auto manufacturer as an official importer, such as the companies that are members of i-Via (Israeli Vehicle Importers Association).

Cipia Awarded 7 Design Wins with Major European CV Manufacturer

Cipia (TASE: CPIA), an AI computer vision in-cabin automotive solutions provider, announced that it had been awarded new design wins with a new OEM, a leading European commercial vehicle (CV) manufacturer. The deal, Cipia’s second with a European OEM this year, will see Cipia’s Driver Sense driver monitoring system (DMS) integrated into seven new models of trucks and buses. The models will be manufactured in Europe and sold worldwide, with a start of production expected in late 2025.

Free-Trade Agreement Between Israel and China to be Postponed

A free-trade agreement between Israel and China that was supposed to be signed before the end of the year will be postponed to an unknown date due to the “Iron Swords” war. Negotiations in the agreement have moved forward significantly in the past months, and its signing included eliminating customs taxes on Chinese cars and several large-scale joint infrastructure projects between Israel and China.

Ministry of Finance Mulling Postponement of Purchasing Tax Increase for EVs

The Israeli Ministry of Finance is considering postponing the scheduled increase in purchasing tax for EVs and PHEVs. According to the plans, in January 2024, the tax benefit given to PHEVs was supposed to be canceled, and the purchasing tax for EVs to increase from 20% to 35%. Given the instability of the Israeli auto market and the economy in general, the technical and logistical hurdles that the war created, and the lack of manpower recruited to the reserve army, the ministry is considering postponing the tax rise.