Major Automotive Global Trends - January 2024

February 13, 2024

Global

The global auto market recovered significantly during 2023, led by EV sales. Projections for 2024 are optimistic for now

The year 2023 ended with a global passenger sales surge with 90 million units, an increase of 11% compared with last December, according to data from the research company Global Data. This results from a significant improvement in production capacity following the end of the “Chip crisis” and the strong export from China that grew by 24% and invigorated the entire global industry. North America registered a 15% increase in car deliveries whereas Europe rose only 4%.

The research firm states that 2023 registered the highest sales level since COVID-19, although the financial risk level was higher. The company projection for passenger car sales in 2024 is 92.4 million units, a nominal increase of 2% compared with 2023.

Also, the regulatory pressure on the auto industry to shift to EVs is still present, and a prolonged expansion of the EV market during 2024 is anticipated.

However, new research by global market research firm Rho Motion estimates that global EV and PHEV sales will reflect a 31% growth. This is a significant slowdown from the 2022 growth rate, which stood at 60%, but the researchers say it is a natural situation that characterizes growing markets.

According to Rho Motion, EV sales worldwide broke a new record in December 2023 with 1.5 million units. As for 2024, the researchers expect EV sales to grow by 25-30%.

According to the data, in 2023, 13.6 million BEVs and PHEVs were sold, 9.5 million of which were purely electric BEVs. The most significant growth rate was registered in North America, where EV sales grew by 50%. Europe follows with 27% growth and then China with 15%.

The company estimates that auto companies are worried that the demand will slow down while customers await improvements, smaller and cheaper EVs. However, only 8% of EV sales in Europe this year were of small cars. The research company also estimates that Germany's decision to cancel EV subsidies at the beginning of 2024 will also have a negative effect on market growth.

Europe

The investigation into Chinese manufacturers “Flood” policy conducted by the EU is progressing

The “Anti damping” investigation by the EU Commission against Chinese EV manufacturers was stepped up in January. At the end of 2023, the investigation focused on examining documents that the Chinese manufacturers were asked to present. However, in January, the investigators were already visiting EV manufacturing plants in China.

The investigation began following claims made by EU states that EV manufacturers that export from China to Europe are utilizing severe government subsidies that harm the free competition in the European car market. Last September, during the announcement on opening the investigation in the European Parliament in Strassburg, the president of the EU Commission, Ursula Von Der Leyen, said, "The EV industry is vital for promoting the green economy and has great potential for Europe. At the same time, world markets are now flooded with cheap Chinese EVs, whose prices are kept low artificially through massive government subsidies… this situation distorts the local market… we don’t accept that behavior among companies in the EU or outside of it… Europe is open for competition but not to destructive moves”.

The investigation faced strict reactions from the Chinese government, which claimed that “The EU investigation is meant to defend the local industry in the name of ‘Fairtrade’ but is, in fact, pure protectionism. This will disrupt and distort the industry and the global supply chain, including in the EU, and will have a negative effect on the economic and trade relations between China and the EU”. Also, in January, the Chinese ambassador attacked the investigation, calling it “Unfair”. He said that China is collaborating with the investigation, but the EU also gives subsidies to companies operating within the EU and hinted that China might open an ‘Anti-flooding’ investigation of its own. According to him, if China was to open such an investigation, “Many issues would be investigated”.

Meanwhile, it seems the Chinese government is being forced to collaborate with the investigation and organize visits to China, including government-owned companies. The investigation is due to be completed within 13 months, and should it be determined that there is a ‘Flood export’ of cheap Chinese EVs from China to Europe, the EU is expected to impose custom taxes on cheap Chinese EVs.

EU institutions reached initial agreement regarding the plan for lowering CO2 emissions from heavy commercial vehicles

Following long discussions, the EU Council and the European Parliament reached an initial and general agreement regarding the outline and future values of CO2 emissions from trucks, buses, and heavy commercial vehicles in Europe. The agreed values match the ultimate and original outline of the commission, which is decreasing the average emissions from trucks by 90% by 2040 and a complete shift to electric propulsion in city buses by 2035.

According to the agreement, by 2030, the average CO2 emissions from trucks over 7.5 tons will be lowered by 45%. In the next phase, by 2035, the decrease will reach 65% and, five years later, by 90%.

As for city buses, the agreement states that the average emissions of bus fleets will be lowered by 100% until 2035. That is a complete shift to electric propulsion by 2035. That is a compromise compared with the original draft of the EU Commission that aspired to this goal already by 2030. Instead, an intermediate goal of a 90% decrease was set for that year.

The agreement also states that the EU commission will examine in 2027 the effectiveness and real-world influence of the set goals. Also, the policy regarding heavy vehicles that operate on “Carbon neutral” fuels whose production process is “Green,” such as E-Fuel, will also be examined. The feasibility of using such fuels for heavy vehicles has yet to be tested.

The agreement exempts three categories from meeting the goals: designated work trucks that are produced in limited series for specific uses such as for agriculture, Foresting, and mining, fire trucks, and trucks for policing, internal security, and medical aid. In addition, there is an exemption for garbage disposal trucks and concrete mixers, which will be exempt from the intermediate goal of 2030 but must comply with the 2035 emission reduction goal. The next phase is to present the temporary agreement for approval by the EU state representatives in the commission and the environment committee of the parliament.

European market 2023 deliveries: an increase of 14%, but December broke 16 months increase sequence

Passenger car deliveries in Europe in 2023 amounted to 12.85 million units, an increase of 13.7% compared with 2022, according to data published by the ACEA. A consistent rise in monthly sales was kept from January to November, but it stopped in December. The association estimates that 1.05 million vehicles were sold in December, a 3.8% drop from last December that ended a positive sequence of almost 16 months.

The main reason is probably a decline in demand for EVs, especially in Germany - the largest auto market in Europe. Germany registered a steep decrease in demand due to the early termination of the subsidy program for EVs. This trend also contributed to the decline in demand in other large EU countries as well.

The yearly summary shows an increase in demand in almost all European markets except Norway, which registered a 27% decrease, and Hungary, with a drop of 3.5%. The growth was led by Italy (18.9%), followed by Britain (17.9%) and France (16.1%). As said, Germany was influenced by the weakening of the market for EVs and demonstrated a 7.3% yearly growth only.

The data shows that EV sales grew in 2023 by 28% and overtook diesel, even though in December they dropped by 25% compared with last December (led by Germany, where EV sales were slashed by 50% in December due to the cancelation of the subsidies). Some manufacturers, including VW, Mercedes, and Tesla, announced that they would absorb the tax raise, but that was not enough to block the decrease in demand.

Leading analysts project that in 2024, the slowdown trend in demand will continue due to the cost of financing, slow economic growth in some states, and a decline in demand for EVs. According to some projections, sales growth in Europe in 2024 will be only 5%. This trend may pressure manufacturers to lower prices and will be manifested in their sales performance and profits. The analysts mention that in January, the initial influences could be seen when Tesla slashed the cost of the Y model, its’ best-seller, in markets such as Germany, France, and Norway.

France’s new “Green tax” reform imposes increased fines on polluting vehicles

The French government’s new and radical “Green tax” reform, effective from the beginning of January, keeps making waves in the industry. At the base of the reform stands a “Selective” mechanism for EV subsidizing based on the overall CO2 emissions of car models from the production process, transportation, raw material production, etc.

As a result, almost all EVs from the east sold in France have lost their eligibility for thousands of Euros in government subsidies. In the list of EVs eligible for the subsidy, published by the French government in December, there are no Chinese-made models, and almost all the eligible models are European-made, including Tesla Y, which is manufactured in Germany.

However, at the same time, the reform also imposes a one-off “Eco fine” on especially polluting models at the time of registration in France. The new tax/fine is based on CO2 emissions and starts at the very low threshold of 118 Grams/Km, according to WLTP, which incurs a fine of 50 Euros. But the fine increases dramatically as emissions increase. At the highest level, with emissions higher than 194 grams/Km, the model is fined by no less than 60,000 Euros.

In addition, there is a fine for polluting vehicles as a function of their weight. Families with many children who need larger and heavier vehicles can apply for a fine reduction as long as they apply within six months of the initial registration.

At the same time, the French government continues to be criticized by its’ trade partners, claiming that the new green taxation harms the competitiveness of their car exports to France. On January 17th, the South Korean government filed France with a request to “Correct” the criteria for models eligible for subsidy and return them to the list of popular South Korean-made models such as the Kia Niro EV.

Sources in the South Korean government said, "Comprehensive bi-literal negotiations on the subject” are underway. On the other hand, unofficial sources in South Korea said that the government may look into worsening the trade terms of French companies and products that are either operating or competing in tenders in Korea.

Italian government mulling a “Social” green tax to encourage swapping polluting vehicles with green ones

The Italian government is operating to revise its’ green tax program, but many of the moves it is planning are more “Social”. News agencies reported that the government in Rome is formalizing a 930 million Euros subsidy package that will be given in the form of “Replace your old ICE car with a new EV”.

The government aspires to create a mechanism for subsidizing low-income families who are holding old cars that comply with the polluting EURO 2 standard. According to the criteria, families with an annual income of less than 30,000 Euros will receive up to 13,750 Euros if they replace their old gasoline or diesel car with a new EV, provided that their vehicle is at least 20 years old.

The goal is to rejuvenate the Italian car fleet, one of the oldest in Europe, which includes at least 11 million cars that comply with EURO 3 standards or less. Furthermore, the EV market share in Italy is smaller than in most EU countries. The plan will be represented in a meeting with the auto industry representatives on February 1st.

It should be noted that Italy already examined the past new mechanisms for creating incentives for EVs. In October 2023, it was reported that it is considering adopting a subsidy method similar to that of France, which is based on the overall pollution of the car and the environmental impact of the materials used for its production (including the battery), assembly, and transportation. However, whether this plan is still on the government’s table is unclear.

Auto industry estimates that the target date for a complete shift to electric propulsion may be postponed

The EU presents the decision to set 2035 as the date target for the stoppage of ICE car marketing in Europe as an outstanding environmental achievement. However, behind the scenes, voices claiming this goal is unachievable are starting to be heard.

At the end of January, the CFO of the Porsche group said in a conference, "There is a lot of talk about the end of ICE cars production, but we believe that the date (2035) may be postponed”. The reasons for that, among others, are a steep decline in EV orders in the EU and a reduction or stoppage of government subsidies, which lead many to wonder if the EU can meet its own schedule. Also, problems and delays in the deployment of a public charging station network on the mainland are delaying the plan.

European auto parts industry: more than half of European auto parts manufacturers are at risk

In January, the European Association of Automotive Suppliers (CLEPA) announced that the profitability of more than half of the European auto parts suppliers is below the 5% threshold needed for business sustainability.

According to the association’s CEO, “Many suppliers are at risk due to the accumulation of many factors including the need for heavy investments in technologies that their future is uncertain, COVID, inflation, energy costs, new regulations and more”.

The heads of the CLEPA called the parliament of the EU to ensure that regulations remain “Stable and efficient”. According to the association, collaboration between a few industries is needed to achieve the goal of carbon neutrality by 2050. During the last year, the auto industry received a few leniencies from the EU regulators, including a commitment to allow the use of synthetic fuels until 2035 and the EURO 7 emission regulations that were considerably eased compared to their original version. However, implementing these regulations may be postponed after the election of the new European parliament this coming spring. According to the Association, “As the elections are nearing, so will the European Commission's chance to present new proposals becomes smaller”.

CLEPA also claims that the main problem ahead is the loss of jobs due to shifting to EVs. It estimates that up to half a million out of 1.7 million jobs in the supply chain for the European auto industry may be canceled by 2040 in the pessimistic scenario, or 276,000 jobs canceled in the optimistic one. In this context, the association believes that “We still have a chance to save existing jobs, but eventually it depends on competitiveness. It is possible if Europe invests in innovation”.

USA

Biden administration approves an additional 623 million US$ for the deployment of a charging network in rural areas

Regulators in developed countries are continuing to advance the deployment of charging infrastructure for EVs. In January, the Biden administration announced the allocation of an additional 623 million US$ for funding electricity and Hydrogen charging infrastructure in the country, emphasizing remote towns and rural areas.

This is another phase in the federal grant plan to expand the charging and fueling infrastructure (CFI), whose overall scope is 2.5 billion US$ over five years. The first 700 million US$ allocated for 2022 and 2023 were released last March. In January 2024, the administration announced it would distribute an additional 623 million US$ for 47 projects in 22 states, including Puerto Rico. Among other things, establishing 7,500 fast charging stations will be financed.

The new plan complements the 5 billion US$ National EV Infrastructure (NEVI) program, the criteria for which were published in February 2023. The charging stations that will be established as part of it will have to meet the exact technical requirements. But whereas the NEVI program focuses on fast charging stations along the highways, the new plan focuses on establishing alternative fueling (including Hydrogen and gas) and charging stations in remote towns and rural areas, especially in “Weak” socio-economic regions.

The overall 2.5 billion US$ budget is divided equally between two main areas: the “Community program” that subsidizes green energy fueling stations such as Hydrogen, Propane, or natural gas on public or semi-public land, and the “Corridor program” that advances the establishment of charging stations and infrastructure for fueling Hydrogen, Propane or natural gas along “Designated corridors for alternative fuels”.

Both programs are part of the Biden Administration Environmental Infrastructure Act, designed to establish a reliable, cheap, and comfortable national network of charging stations for US-made EVs, including at least 500,000 stations accessible to the public by 2030. The program should also encourage the American workforce to produce EVs in the US.

The American auto industry protested the outline for decreasing emissions and fuel consumption that was presented to the Biden administration

On January 19th, the Environmental Protection Agency (EPA) presented to the white house the final draft of its outline for reducing emissions and fuel consumption from vehicles sold in the US over the next decade. That, after conducting a public hearing in which it received over 250,000 claims and objections. The plan's ultimate goal is that more than two-thirds of all new cars sold in 2032 will be EVs. Should the proposal, designed jointly by the Ministries of Transportation and Energy, be accepted, it may have far-reaching repercussions for the US auto industry.

The formula and goals of the outline faced fierce public debates against lobbyists and interest groups up to the last minute. In December 2023, the “Alliance for Automotive Innovation”, the main lobbying body of the industry, even warned that “Aggressive goals will force the auto makers to stop producing popular gasoline models at once, and cause price increases”. That, even though the EPA’s outline relates only to new cars sold after 2027. The Alliance estimated that such an outline would cost the large American automakers over 14 billion US$ in fines due to deviation from the targets.

The issue quickly turned into a political one in pre-election USA, and 16 republican governors approached President Biden asking him to reject the EPA’s suggestion that set the standards for encouraging EVs instead of petrol cars, claiming that “The American public is not interested in passenger and commercial electric vehicles”.

Frozen weather in the US impacts car sales in January

New car sales in January 2024, including sales to private customers and fleets, are expected to reach 1.088 units, a decline of 1.5% compared with January 2023, as the monthly forecast of J.D Power research company reveals. Sales to private customers are expected to reach 862,000, 1.8% less than last January.

The company said that the sales rate in January was slower than in December, which was a record-breaking month, but that it was primarily for “Technical” reasons related to the end of the calendar year, such as preceding purchases of EVs due to regulation changes in the US and substantial discounts by the dealers to “Clean” their inventory.

According to the company, dealers' inventory levels in the US in January were around 1.6 million units, a 3% rise from December 2023 and 38% more than in January 2023. The average deal price for private passenger cars in January was 45,000 US$, a drop of 1,600$ or 3.5% compared with last January. The average profit per unit, including income from insurance and financing, is expected to be 2,800$ in January, 28.5% less than last year. The leading cause for the drop is the number of vehicles sold above the MSRP. Only 18.5% of the new cars sold in January were priced above the MSRP, compared with 33% in January 2023, characterized by low inventories.

In January, 32% of cars are expected to sell within ten days of arriving at the dealership, a drop from the 58% record registered in March 2022. The average time for a car to be at the dealer’s before being sold was 40 days in January, 13 days more than last year.

Manufacturers' incentives are expected to drop in January by 270$ from December, but they were raised significantly compared with last year when they were at a low. The average incentive in January was 2,340$. 25.5% of sales to private customers in January were by leasing, an increase of 8% from January 2023.

However, the projection for January by S&P Global Mobility sees a more moderate growth in the passenger car segment for 2024. The company estimates that production capacity will continue to grow, and dealers' inventories will grow as well, adding pressure for price drops. As far as 2024, the company estimates 16 million units, a humble increase of 3% compared with 2023.

The company’s researchers mention that “American auto consumers continue to be affected by the economic uncertainty. While positive developments such as a mild price drop, inventory increases, and raised incentives are expected, interest rates remain high, creating a countermeasure… unstable purchasing environment for auto consumers will continue to affect the monthly sales levels”.

The company also estimates continued growth for the EV segment with month-to-month volatility. In January, the EV market share is expected to be around 8%, while manufacturers, dealers, and consumers are trying to digest and internalize the new federal tax incentives for EVs.

South-Korea

South Korea will check whether producers of batteries and chemicals for batteries are infringing patents

Lately, the South Korean auto industry has been affected by several steps, among them the “Nationalistic” subsidizing plans of different countries. Now, they seem determined to adopt a “Nationalistic” car policy of their own. On January 11th, in a meeting of the South Korean Ministry of Industry and Trade, it was decided to investigate patent and copyright infringement in batteries and compounds for battery production imported from China.

The formal focus of the investigation is producers and importers of Chinese smartphones, but Chinese EVs imported to Korea may also be indirectly affected. The investigation was launched as a reaction to the claim made by Korean companies that the chemical formulas of the materials used for producing the cathodes in batteries were copied from them while infringing patent rules. At the same time, the Korean trade committee opened an “Anti-flooding” investigation regarding Chinese-produced polyethylene terephthalate, which is also used in the auto industry.

It should be noted that Chinese EV deliveries in South Korea leaped in the past two years, although most of the imports are of Tesla cars manufactured in China. Tesla even became the best-selling “Foreign” brand in the Korean market. At the same time, the Chinese auto industry is quickly pushing the Koreans from many markets in Southeast Asia, especially in the EV segment.

For instance, current delivery figures from Australia reveal that Chinese-made cars managed to overtake the South Koreans for the first time and conquered third place in deliveries. Last year, 193,433 Chinese cars were sold in Australia, most EVs. This represents a 57.5% increase from 2022. Most of the deliveries were of cheap EVs.

Foreign auto manufacturers are quickly integrating into South Korea's EV charging market

The public charging infrastructure for EVs in South Korea was having trouble keeping up with the growth in the number of EVs in the last few years, and the market created a demand surplus. In this vacuum, foreign automakers are now entering and strengthening their market share.

According to data published in Korea in January, German BMW already operates an independent charging network with more than 1,100 charging stations, and it intends to double that amount this year and open them to charging for all EV types, not just BMW. By the end of the year, its network will compose 50% of all branded charging networks of automakers in the country.

Mercedes also intends to launch a fast public charging network by the end of 2024 with an investment of tens of millions of US$. The Germans will be joined by Volvo, which intends to invest 100 billion Won (74.6 million US$) to establish six service centers with fast charging services in the country. Today, the company has 34 service centers with 40 fast charging and 61 slow charging stations. Porsche also intends to expand its EV charging network in South Korea to 250 fast charging stations by the end of the year.

China

Chinese auto market continues to grow in 2023

The number of motorized vehicles approved for moving on Chinese roads increased in 2023, so data from the Chinese Ministry of Internal Security was published in January. At the end of 2023, there were 435 million vehicles, of which 336 million passenger cars constituted 77% of the total.

In 2023, 34.8 million new vehicles were registered, including two-wheeled vehicles – a record of almost five years. Of these, 24.56 million were passenger cars, an increase of a million units compared with 2022, although still far from the industry’s record years between 2016-2018.

The secondhand car market in China registered double-digit growth in 2023 with 34 million transactions – an all-time high. The Chinese explain these figures as being due to the prolonged COVID-19 curfews that prevented transactions between different provinces in China.

According to data from the Chinese Private Vehicles Association, 9.5 million units of the 30 million new cars that joined in 2023 were “New energy” cars, especially EVs and PHEVs. That represents a 39% growth YOY that brought the number of new energy cars in China to 20.41 million units at the end of 2023, of which 15.52 million are BEVs.

In 2023, eleven more cities in China joined the “Million Club” of cities with more than a million vehicles in their jurisdiction. There are now 93 Chinese cities in that club, five with more than ten million vehicles.

Israel

During January, as part of the preparations for the 2024 budget, several strategic green tax regulation programs were introduced, but it is unclear to what extent they will be realized

In January, the Ministry of Finance introduced a new outline for tax incentives for EVs and mileage tax. The programs were included in the new budget proposal and even approved, but a few changes occurred during January that created significant uncertainty regarding the outline of the green tax incentives from 2025 onwards. Following is a recap of the main developments:

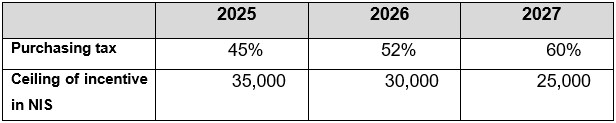

- On January 9th, the Ministry of Finance presented the budget draft for the fiscal year 2024, including a new outline for decreasing incentives for EVs. According to the outline, the tax rate was supposed to climb to 50% and reach 65% by 2027, while the ceiling of the incentive in NIS will gradually decrease from 35,000 NIS in 2025 to 25,000 NIS in 2027. On January 15th, a final draft resolution of that same budget was presented with a more moderate purchasing tax outline, in which the purchasing tax on EVs will increase to only 45% in 2025. The approved outline is as follows:

However, the budget states that decreasing the purchasing tax outline depends on the approval of mileage tax.

- In that same budget proposal, the reduced yearly registration fee for EVs was canceled. The expected revenues from this cancelation in 2025 are 500 million NIS.

- The same budget proposal approved imposing a mileage tax on EVs and PHEVs of 0.15 NIS per Km. The budget also sets a mechanism for collection, updating the tax, etc. According to the proposal, this tax is expected to add to the state’s treasury 1.54 billion NIS in 2026 when it takes effect. It should be noted that the budget conditioned the purchasing tax outline with the approval of the mileage tax. The Ministry of Finance claims that without mileage tax, there will be no alternative outline for EV tax benefits, and as a default, the purchasing tax on EVs will be equaled to that of ICE cars (83% with green grade benefits) starting from January 2025.

- In that same budget, a plan for a comprehensive reform in the existing green tax regulations appeared for the first time in formal documents. According to the budget proposal, “In consultation with the ministers of energy and infrastructure and the minister for environmental protection, we want to examine the possibility that starting from 2026, there will be a mechanism that includes greenhouse emission targets that will encourage the importation of electric vehicles and vehicles with low greenhouse emissions… this by paying attention to the methodology of similar mechanisms worldwide”. The meaning is a shift from giving each model a specific green grade according to a unique Israeli formula that weighs a few pollutants to a mechanism that sets an average CO2 emission target for the product line of each importer. In case of exceeding the target, the importer pays a fine. This plan was approved as part of the final budget, but it is still unclear at what operational stage it is and if it’s feasible.

- On January 29th, it was published that the proposal to impose mileage tax in 2026 would not pass as part of the budget law but would be removed from it and would go through a separate legislation process that is not part of the budget. According to estimates, that significantly lowers the chance that the bill will be passed in 2026. At the same time, the outline for canceling the tax benefits for EVs from 2025 may be canceled as well since the mileage tax has conditioned it. It is still unclear how this will be resolved and what it means for EV purchasing tax in January 2025.