Monthly Review March 2024

April 21, 2024

Preface – Economic Climate

On the morning of October 7th, the State of Israel fell victim to a reprehensible and traumatic terror act that claimed innocent civilians’ lives. Israel is now compelled to engage in warfare as it responds to these unprovoked and barbaric onslaughts. This conflict will indubitably impact Israel’s near-term and long-term trajectory across many areas, including financial stability. Many indices are apt to shift dramatically in forthcoming assessments, as is inherent to the nature of wartime (e.g., inflation, foreign exchange rates, employment).

Therefore, updated data will be presented with minimal additions where possible.

The Israeli economy is an advanced economy that participates in the OECD organization.

Israel’s GDP per capita is $53,449. Its growth rate in 2023 was 2%, while the current forecast for 2024 ranges between 1.6 and 3.1%. Israel maintains a 6.2% deficit of the GDP from April 2023 to March 2024. The debt-to-GDP ratio increased to 62.1% in 2023, and the unemployment rate in February 2024 was 3.3%.

As of March 2024, the annual inflation growth rate is 2.7%. In March 2024, the short-term interest rate was 4.5%, while the long-term interest rate stood at 1.67% (as of February 2024).

Statistical Profile

Society

Population (February 2024): 9.867 Million

Economy

GDP per capita (March 2024): $ 53,449 (NIS 194,019)

Inflation (March 2024) (Annual Growth Rate): 2.7%

Current Account Balance (December 2023): 5% of GDP

Trade in Goods and Services (March 2024): $13.44 billion ( NIS48.8 billion)

Finance

US Dollar Exchange rate (March 2024, Avg.): NIS 3.63

Euro Exchange rate (March 2024, Avg.): NIS 3.96

Long-term interest rates (February 2024): 1.67% Per Annum

Short-term interest rates (March 2024): 4.5% Per Annum

Government

Debt to GDP ratio (2023): 62.1%

Deficit to GDP (April 2023 - March 2024): 6.2%

Motorization

Level of Motorization (2023): 417 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2021): 5.557% of GDP

Environment

CO2 Emissions (2022): 6.2 Tonnes Per Capita

Jobs

Employment Rate (February 2024): 62.5% of the Working Age Population

Official Unemployment Rate (February 2024): 3.3% of the Labour Force

New Cars and CV Registrations

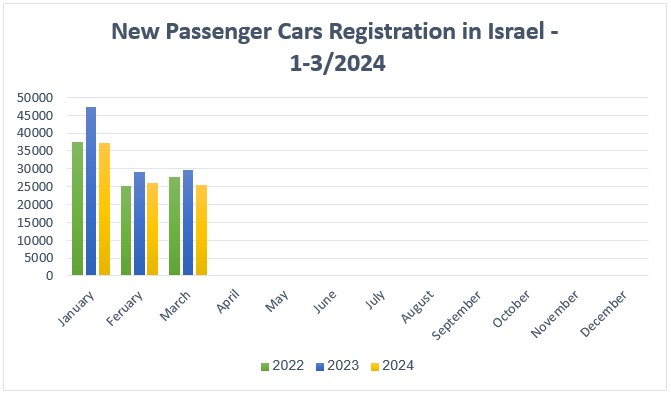

New Passenger Car Registration: Jan-March 2024

Passenger car registration: Decrease of 16.6% compared with Jan-March 2023.

In March 2024, the Israeli passenger car market registered 25,551 new cars - a decrease of 13.5% compared with March 2023. Since the beginning of the year, 89,041 new cars were registered, a decrease of 16.6% compared with last year. Since January, 22,398 BEVs and 3,485 PHEVs, a total of 25,883 cars with chargeable electric drive, were registered, representing 29% of all registrations. The market share of pure EVs in 2024 is currently 25.2%.

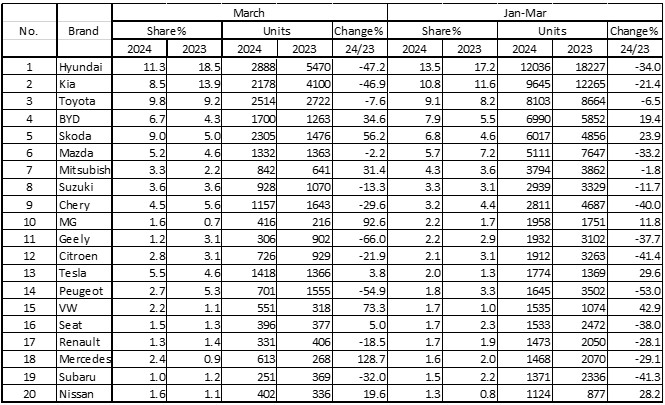

New Passenger Cars Registration According to Brands: Jan-March 2024

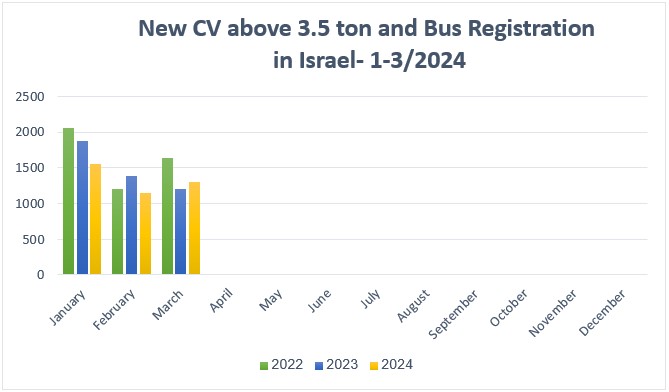

New CV above 3.5-ton Registration: Jan-March 2024

Commercial Vehicles above 3.5 ton registration: +7.7% compared with March 2023.

In March 2024, the Israeli market for CVs above 3.5 tons registered an increase of 7.7% in deliveries with 1,301 new registrations, compared with 1,208 units in March 2023. Since the beginning of the year, 3,993 units were delivered, a decrease of 10.8% compared with last year.

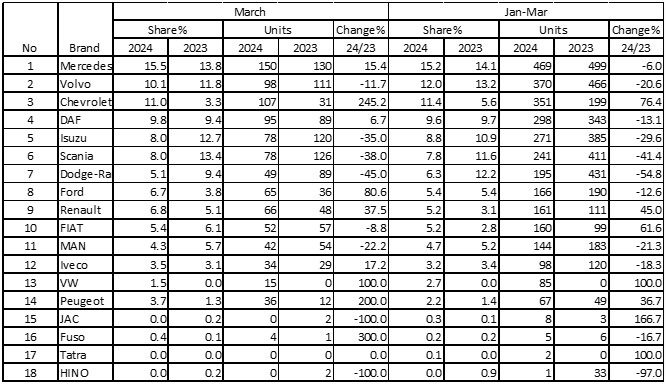

New CV above 3.5-ton Registration According to Brands: Jan-March 2024

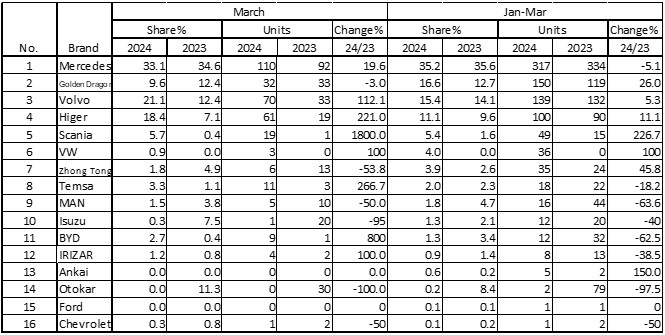

New Bus Registration According to Brands: Jan-March 2024

Israel's Auto and Auto-Tech industry

Pango is in advanced negotiations to acquire Gett

After the negotiations with Fortissimo Capital fell through, Gett is in advanced negotiations for a sale with Israeli company Pango. The negotiations are conducted around a value of 800-900 million NIS for Gett ($220-250M). For Pango, this represents a synergistic opportunity, as it aims to combine parking and travel services. Gett, which was founded in 2010, has raised $900 million since its inception, with the main shareholder currently being Swedish fund VNV Global with a 43% stake. The value of Gett has fluctuated in recent reports, with estimates as low as $222 million in VNV's recent annual report, which is the value around which negotiations are being held.

Pango, a supplier of digital parking services apps, offers a range of services to its users, including express parking, car washing, parking space location, re-fuelling services, and collaboration with Shagrir rescue services. This deal marks a significant move for Pango, which aims to acquire a company larger than itself. Pango is owned by the Weil family (56%) through the Milgam management company.

Trucknet Registered as a Fuel Company Towards a Pilot for Delivering Fuels Overland from Israel to the Middle East

On March 6th, Trucknet reported signing a pilot agreement and an MOU with a company from the Persian Gulf for transporting furls from Israeli ports to a designated facility in an Eastern country. The company announced that it had been registered with the Israeli Fuel Administration in the National Infrastructure Ministry as a fuel company, authorized to import, export, and market fuels. The pilot will be carried out using Trucknet’s platform and “Land-bridge” for overland transportation. Should the pilot be successful, Trucknet will supply the Persian Gulf company with 2 million tons of fuel over five years – approximately 800 trucks a month will use the “Land-bridge” already operational.

Electra Group to Import Yutong’s Electric Buses to Israel

The Electra group signed an agreement with Chinese bus company Yutong, making it the direct importer of its electric buses in Israel. The activity will be carried out via an Electra Motors subsidiary company and includes parts and maintenance services that Electra will provide to its local customers. Yutong buses were previously imported to Israel by China Motors. The new agreement signed with Electra is valid until March 2027 and can be extended from then on.

SaverOne Signs Milestone OEM Agreements with IVECO and Volvo

SaverOne 2014 Ltd. (Nasdaq: SVRE, TASE: SVRE), a technology company that develops and sells transportation safety solutions, announced that it has signed an OEM agreement with IVECO, the brand of Iveco Group N.V. (EXM: IVG) that designs, manufactures and markets light, medium and heavy commercial vehicles. The agreement seals the collaboration to develop a solution to prevent driver distraction from cellphone use. The OEM agreement covers integrating SaverOne’s safety technology within IVECO’s vehicles through their manufacturing line. Throughout 2024, SaverOne’s software will be integrated into IVECO’s hardware. Future further evolutions may include the integration of SaverOne’s mobile app with IVECO's mobile app and SaverOne’s hardware and software within IVECO’s assembly line. The first IVECO vehicles with the integrated SaverOne software solution are expected to be delivered this year.

The company also announced that it has entered into an original equipment manufacturer (OEM) agreement with Volvo Bus Corporation, a global automotive giant Volvo Group subsidiary. The agreement covers Volvo buses in the Mexican coach-bus market, a market in which Volvo has leadership with approximately 50% market share of new coach-bus vehicle sales. Under the OEM agreement, SaverOne’s Safety Solution, known as the ‘Driver Distraction Prevention System’ (DDPS), will be installed in new Volvo buses manufactured for the Mexican market. Volvo Bus customers in Mexico will be offered the SaverOne Safety Solution pre-installed, following integration into Volvo’s assembly line. In addition, the agreement also allows for a retrofit of existing buses covered under Volvo’s maintenance agreement (representing approximately 3,000 buses in the market), which will install SaverOne’s Safety Solution as an aftermarket installation.

Colmobil and Schnapp Forming a New EV Charging Joint Company

Colmobil group, the largest automotive importer in Israel, and Schnapp, the largest car battery marketer in the country, are establishing a new joint company that will be held 50:50 by Schnapp and Enerpoint, a subsidiary of Colmobil. The new company, yet to be named, will install and market EV charging points, both AC and DC, with a dedicated App. In the future, the company will develop a solution for a “Blackout scenario” in which the electric grid is not operating, using Enerpoint’s solar energy solutions and energy storage capabilities from Schnapp’s batteries.

Volkswagen Group intensifies collaboration with Mobileye

The Volkswagen Group is intensifying its partnership with Mobileye in the domain of automated driving. The two companies will bring new automated driving functions to series production. Mobileye is to provide technologies for partially and highly automated driving based on its Mobileye SuperVision and Mobileye Chauffeur platforms. In the future, the Volkswagen Group’s Audi, Bentley, Lamborghini, and Porsche brands will use these technologies to rapidly introduce new premium-oriented driving functions to their model portfolios across powertrain types. These include advanced assistance systems for highway and urban driving, such as automated overtaking on multilane highways in permitted areas and conditions, as well as automatic stopping at red lights and stop signs, and support in intersections and roundabouts. Furthermore, the Volkswagen Commercial Vehicles brand is set to be supplied by Mobileye with software and hardware to achieve Level 4 ("fully automated driving"). Volkswagen ADMT, a Volkswagen Group subsidiary, will implement these components in fully electric development platforms based on the Volkswagen ID. Buzz. The goal of Volkswagen ADMT is to bring self-driving ID. Buzz vehicles to series production for mobility and transportation services.

MIA Dynamics Wins Large Order in North America

Israeli micro-mobility company MIA Dynamics received a large order for a thousand units of its light electric cardboard, with 25,000 additional units to come over five years. The order, estimated at 3.5M$ for the first stage and 75M$ in total, is for the company’s MIA Four model. It was made by MIA’s distributor in North America, Quadsolo LLC.

Qualcomm Withdraws from Autotalks Acquisition due to Antitrust Issues

American chip producer Qualcomm has withdrawn from its agreement to purchase Israeli chip company Autotalks. The withdrawal was prompted by regulatory inspections of the transaction - the EU claimed last August that the deal required antitrust approval, and the US Federal Trade Commission was also looking into it. The European Commission cited the deal's importance to OEMs and others who require access to vehicle-to-everything (V2X) semiconductors. The U.S. Federal Trade Commission (FTC) also looked into the transaction.