Trends Analysis of the Israeli market for new vehicles - Q1 2025

May 8, 2025

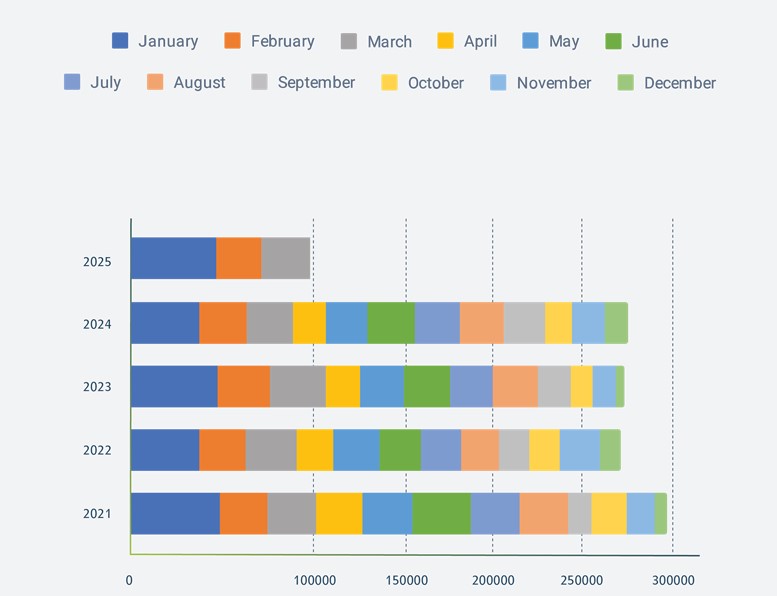

Registration Data

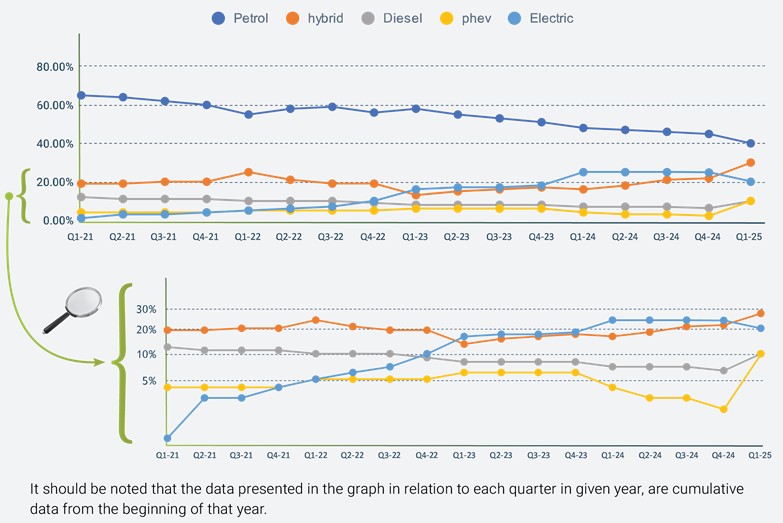

Registration by Engine Type

Petrol vehicles have continued their declining trend, falling from 45% in Q4 2024 to 40% in Q1 2025. This marks a substantial year-over-year decrease from 48% in Q1 2024 and an even sharper drop from 58% in Q1 2023. The data reflects a sustained shift away from traditional combustion engines.

Electric vehicles (EVs), after reaching 25% in both Q1 and Q4 of 2024, declined to 20% in Q1 2025. While this marks a short-term retreat, the EV share remains higher than the 16% recorded in Q1 2023, indicating continued long-term momentum toward full electrification.

Hybrid vehicles showed strong and consistent growth, increasing from 22% in Q4 2024 to 30% in Q1 2025. This represents a major rise from 16% in Q1 2024 and more than double the 13% recorded in Q1 2023, positioning hybrids as a central pillar in the evolving powertrain mix.

PHEVs recorded a sharp rebound, jumping from 2% in Q4 2024 to 10% in Q1 2025. This follows 4% in Q1 2024 and 6% in Q1 2023.

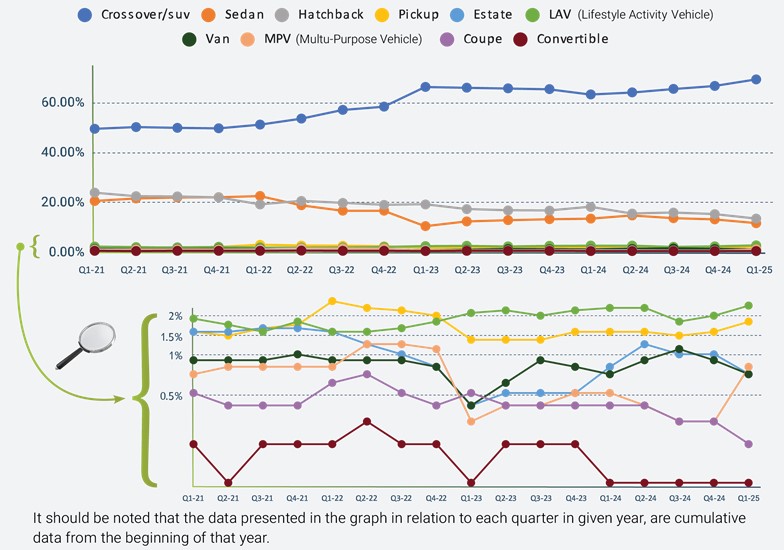

Registration by Segment Type

Crossover/SUV vehicles continue to dominate the market, reaching a new high of 68.9% in Q1 2025. This represents an increase from 66.3% in Q4 2024 and 62.9% in Q1 2024, and a significant rise from 65.9% in Q1 2023. The segment has shown consistent and strong growth, reflecting ongoing consumer preference for higher-bodied vehicles with greater versatility.

Sedan registrations declined to 11% in Q1 2025, down from 13% in both Q4 and Q1 of 2024. While the segment experienced a slight increase from 10% in Q1 2023 to 13% in 2024, the latest figures suggest a renewed downturn, likely due to shrinking demand and competition from compact SUVs.

Hatchbacks continued their downward trend, falling from 15% in Q4 2024 to 13% in Q1 2025. This marks a year-over-year decrease from 18% in Q1 2024 and a drop from 19% in Q1 2023. The hatchback segment appears to be gradually losing relevance as buyers shift toward larger formats.

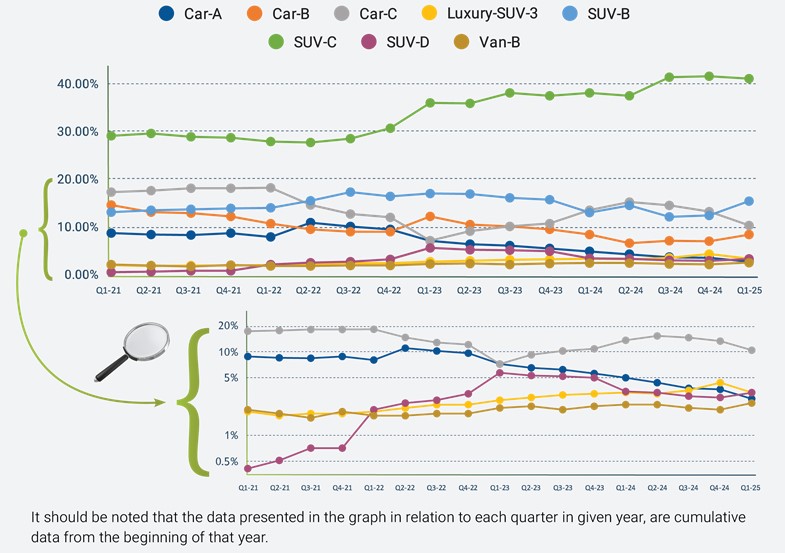

Registration by Category

The SUV-C category maintained its dominant position in the market, reaching 41% in Q1 2025. This is slightly down from the 42% recorded in Q4 2024, but still reflects growth compared to 38% in Q1 2024 and 36% in Q1 2023. The continued strength of SUV-C highlights its broad appeal and central role in shaping the current vehicle mix.

SUV-B registrations increased to 15% in Q1 2025, up from 12% in Q4 2024. This represents a recovery from 13% in Q1 2024 and follows a dip from 17% in Q1 2023. The rebound suggests renewed interest in smaller crossovers, likely driven by fuel efficiency and urban practicality.

Car-C models saw a decline to 10% in Q1 2025, down from 13% in both Q1 and Q4 of 2024. While this still reflects growth from just 7% in Q1 2023, the latest drop may indicate growing pressure from SUV alternatives and changing consumer preferences in the compact car segment.

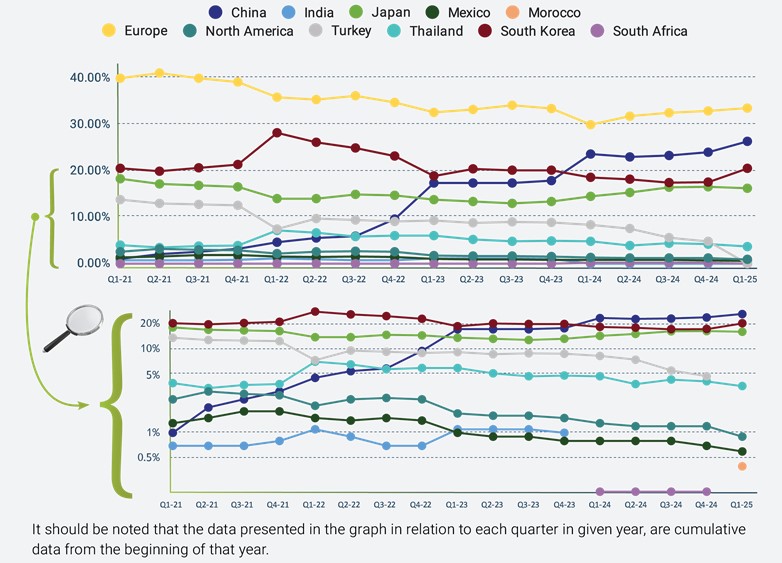

Registration by Country of Origin

Chinese-made vehicles continued their strong upward trajectory, reaching 26% of new registrations in Q1 2025. This marks a steady increase from 24% in Q4 2024 and 23% in Q1 2024, up significantly from just 17% in Q1 2023.

European-made vehicles also strengthened their position, climbing to 33% in Q1 2025. This represents a slight increase from 32% in Q4 2024 and a notable rebound from 29% in Q1 2024. Compared to Q1 2023 (32%), the segment shows consistency, reflecting strong brand loyalty and a broad portfolio across categories and powertrains.

South Korean vehicles rose to 20% in Q1 2025, recovering from a dip to 17% in Q4 2024. This is up from 18% in Q1 2024 and Q1 2023, signaling renewed demand.

Japanese vehicles held steady at 16% in Q1 2025, unchanged from Q4 2024 and up slightly from 14% in both Q1 2024 and Q1 2023.