Trends Analysis - Q3 2022

November 20, 2022

Registration Data

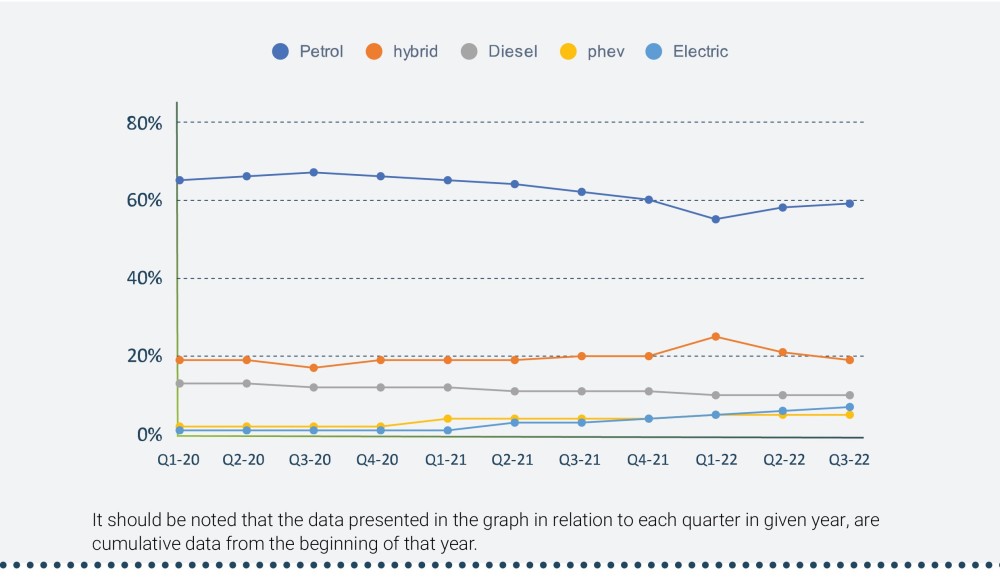

Registration by Engine Type

After a decline in demand commencing 2021, it can be seen that an upward trend in demand for petrol cars continues also in Q3 2022. In Q3 2022, petrol's share of the Israeli car market has grown by 1% compared to Q2 2022. From July to September, 2022 petrol vehicles make up 59% of all new vehicles, a decrease of 3% compared to July-Sep 2021 and 8% compared to July-Sep 2020.

A further decrease in demand for Hybrid Electric Vehicles was observed in Q3 2022 and makes up 19% of all new vehicles, a decrease of 2% compared to Q2 2022, and of 1% compared to July-Sep 2021 and an increase of 2% compared to July-Sep 2020. Hybrid Electric Vehicles are still the most significant volume category of Alternatively Powered Vehicles in Israel.

The demand for electric vehicles in Israel continues its upward trend and increased by 1% compared to Q2 2022 and by 4% compared to Q3 2021 and by 6% compared to Q3 2020.

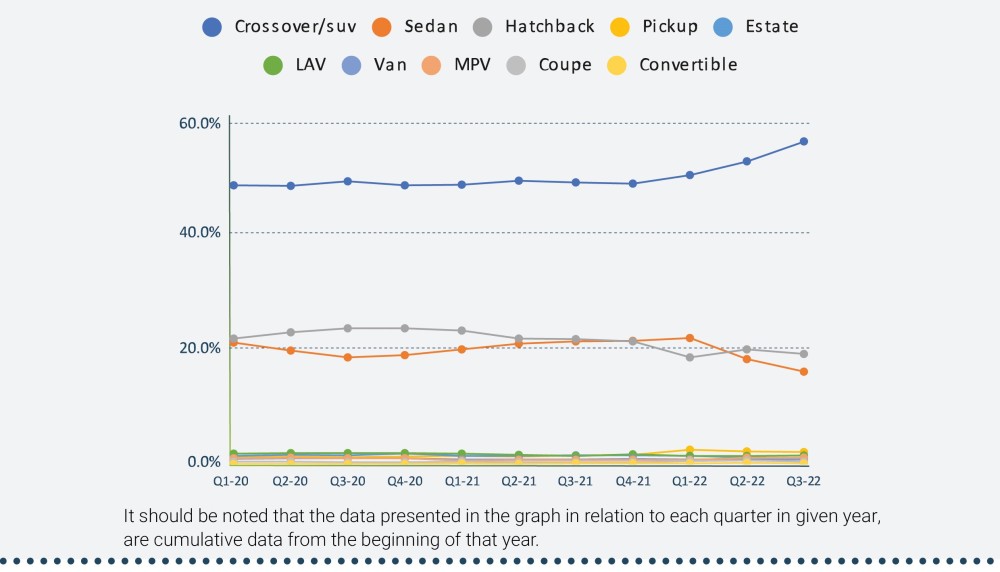

Registration by Segment Type

The demand for Crossover/SUV has remained stable over the past years and continues to lead the market, when in Q3 2022 another increase was observed when Crossover/SUV hold 56.7% of all new vehicles, an increase of 7.2% compared to Q2 2022 and of 3.4% compared to Q3 2021 and of 7% compared to Q3 2020.

Sedan and Hatchback both are the second volume category of new vehicles in Israel in the past years. In Q3 2022 a slight decrease was observed in demand in relation to both. Hatchback vehicles hold 19.4% of all new vehicles, a decrease of 0.8% compared to Q2 2022. The demand for Sedan vehicles decreased by 2.2% compared to Q2 2022 and makes up 16.3% of all new vehicles.

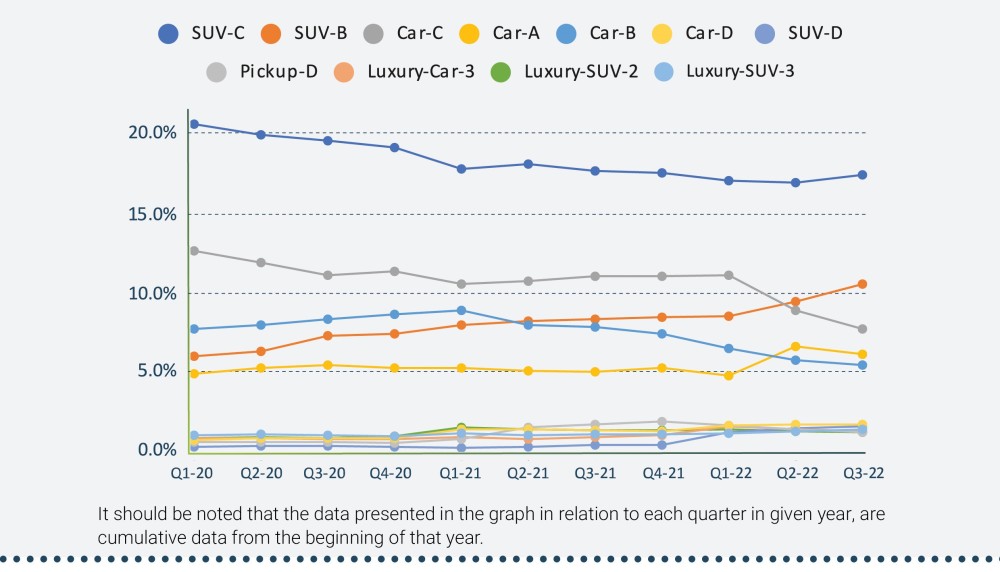

Registration by Category

The SUV-C category leads the market of new vehicles, when from July to Sep 2022, there was indeed an increase of 0.8% compared to Q2 2022, however, such category slightly reduced to 28.4%, compared to 28.8% in the corresponding period in 2021 and significantly reduced compared to 31.9% in the corresponding period in 2020. The demand for the Car-C category in Q3 2022 continued its downward trend and declined by 1.9% compared to Q2 2022 and make up 12.6% of all new vehicles, compared to 18% in the corresponding period in 2021 and 18.1% in the corresponding period in 2020. In contrast, the demand for Suv-B continued its upward trend also in Q3 2022 with 17.2%, an increase of 1.8% compared to Q2 2022, which makes it the second volume category of new vehicles in Israel. The demand for such category rose by 3.6% compared to July-Sep 2021 and 5.3% compared to July-Sep 2021. The demand for Car-B category, is on a downward trend (after an increase in demand was observed during 2020) with 8.9%, an increase of 3.9% compared to July-Sep 2021 and of 4.7% compared to July-Sep 2020. The demand for Car-A category registered a decrease of 0.8% in Q3 2022 compared to Q2 2022, and makes up 10% of all new vehicles.

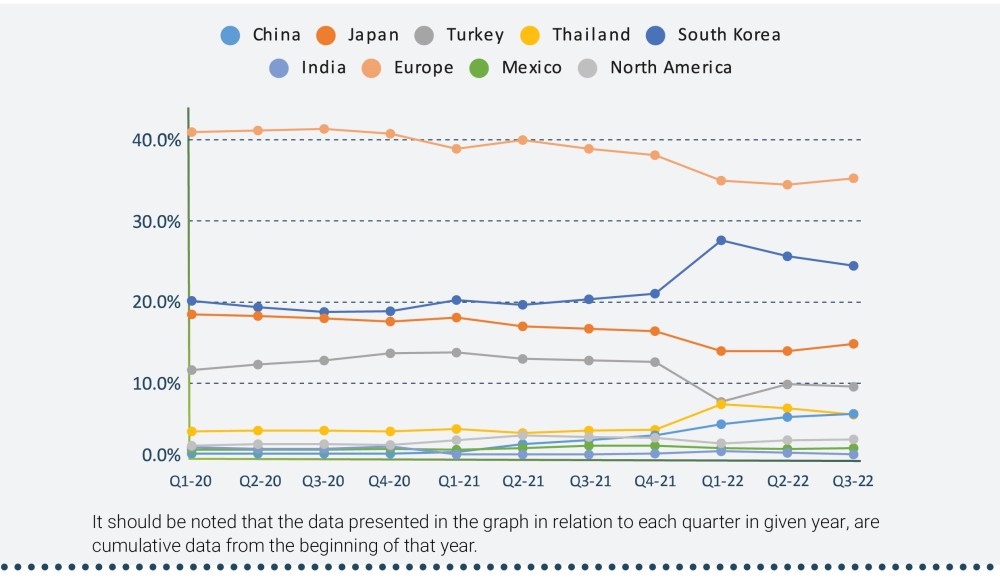

Registration by Country of Origin

As of Q3 2022, 35.4% of new vehicles are manufactured in Europe, a decrease of 3.7% compared to July-September 2021 and of 6.2% compared to July-September 2020.

After an increase in demand for vehicles manufactured in South Korea in Q1 2022, in Q3 2022 another decrease of 1.2% was observed compared to Q2 2022 and such vehicles make up 24.4% of all new vehicles. However, it's still an increase of 4.2% compared to July-September 2021 and of 5.8% to July-September 2020. The demand for vehicles manufactured in Japan in Q3 2022 remained almost unchanged and make up 14.6% of all new vehicles.

The demand for Vehicles manufactured in Turkey also remained almost unchanged and in Q3 2022 such vehicles make up 9.2%, a decrease of 3.3% compared to July-September 2021 and to July-September 2020. In Q3 2022, such vehicles market declined by 0.3% compared to Q2 2022.